How to Change the Principal Place of Business in GST: A Step-By-Step Guide

The Goods and Services Tax (GST) regime has significantly streamlined the taxation process in India. With businesses growing and evolving, there might be situations when a registered taxpayer needs to change the principal place of business. Whether it’s due to relocation, expansion, or any other reason, it’s essential to know the proper procedure. As your trusted tax consultant, we present a detailed step-by-step guide on how to modify the principal place of business in the GST portal.

1. Understand the Basics:

Contents

- 1. Understand the Basics:

- 2. Login to the GST Portal:

- 3. Navigate to the Services Menu:

- 4. Opt for Business Details Modification:

- 5. Edit Principal Place of Business:

- 6. Attach Necessary Documents:

- 7. Addition/Modification of Additional Places:

- 8. Verification Process:

- 9. ARN Generation:

- 10. Verification by GST Officer:

- 11. Approval and Certificate:

- Conclusion

Principal Place of Business: It is the primary location within the State where a taxpayer’s business activities are performed. This is the location mentioned in the GST Certificate and where essential records are kept.

Additional Place of Business: Any other place where a taxpayer conducts business, apart from the principal location.

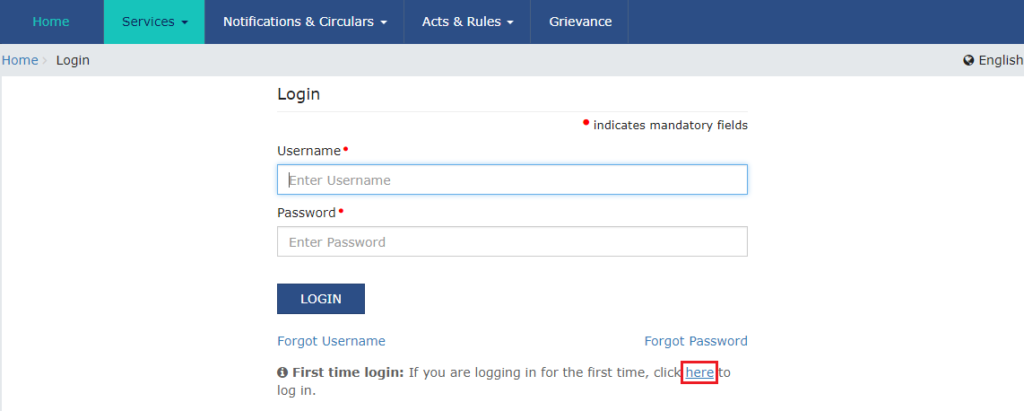

2. Login to the GST Portal:

Visit the official GST portal at https://www.gst.gov.in/. Use your credentials to log in. Ensure you have a valid username and password, as this portal will be your primary gateway for the change.

Once you are on the dashboard, hover over the ‘Services’ tab. From the dropdown menu, choose the ‘Registration’ option and then select ‘Amendment of Registration Core Fields’.

4. Opt for Business Details Modification:

Upon selecting, you’ll find various sections that can be edited. Choose the ‘Business Details’ tab. Here, you will find the ‘Principal Place of Business’ section.

5. Edit Principal Place of Business:

You can now edit your principal place of business. Ensure you enter accurate details, including the complete address, PIN code, and contact information. Mention whether the premises are owned or rented. If it’s rented, you will need to provide the rent agreement or a similar document as proof.

Know More: GST LUT Filings

6. Attach Necessary Documents:

Based on the nature of your premise (owned/leased/rented), you will need to attach relevant documents. Commonly required documents include:

- Rent/Lease Agreement

- Electricity Bill

- Property Tax Receipt

- NOC from the owner (if rented/leased)

Ensure that all documents are clear and readable. The size of the attachments should also adhere to the specifications mentioned on the portal.

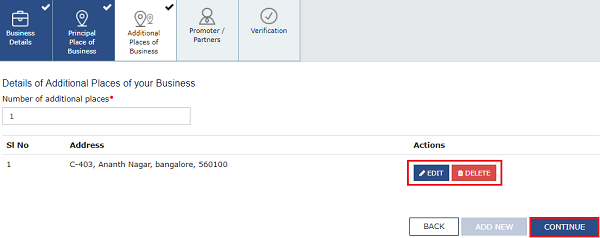

7. Addition/Modification of Additional Places:

If you want to add or modify additional places of business, you can do it in the same section. Remember, any addition might require similar documentation as the principal place.

8. Verification Process:

After making the changes, you need to verify the information. Scroll to the Verification tab, tick the declaration checkbox, and select the authorized signatory from the dropdown. Complete the verification using a Digital Signature Certificate (DSC) or E-signature, based on the nature of your business.

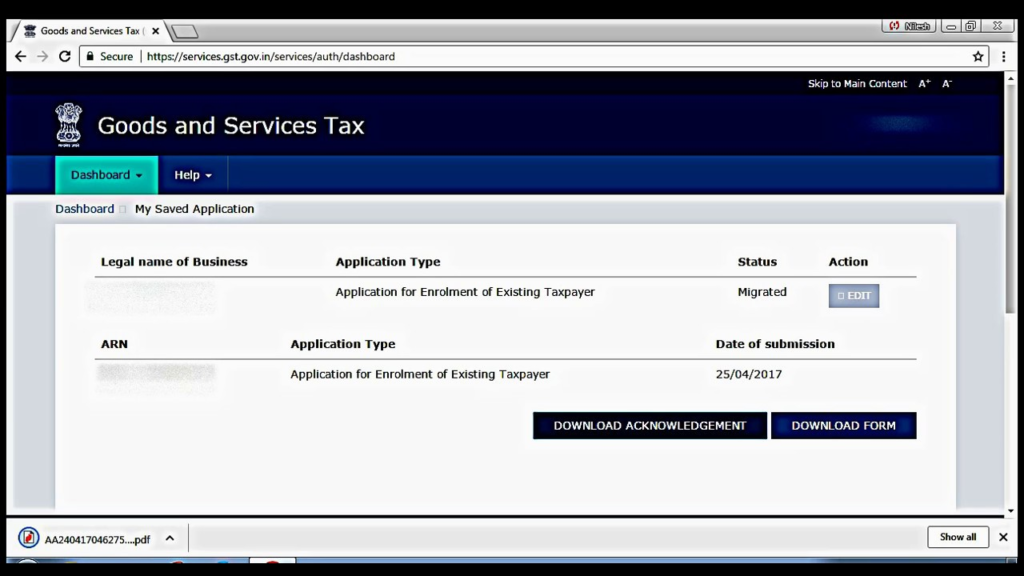

9. ARN Generation:

Upon successful submission, an Application Reference Number (ARN) receipt is generated and sent to your registered email ID and mobile number. This ARN can be used to track the status of the amendment application.

10. Verification by GST Officer:

The amendment application will be processed by a GST officer. If the officer requires any additional clarification or documents, you will be notified. Ensure prompt responses to any queries.

11. Approval and Certificate:

After successful verification, the change in the principal place of business will be approved. A new GST registration certificate reflecting the changed address will be made available on the portal. Make sure to download and keep a copy.

Conclusion

Changing the principal place of business in GST might seem challenging, but by following these steps methodically and ensuring all documents are in place, the process becomes straightforward. Regularly checking the GST portal for any notifications or updates is crucial during this period.

Always remember any change in your business details, especially the principal place of business, must be reflected in the GST registration to ensure compliance and smooth business operations.