Tax Deducted at Source (TDS) is an essential mechanism for the collection of tax in India. It requires the deductor to deduct

- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

GST Registartion Cancellation

GST Registration Cancellation is the procedure that ceases the existence of GST registration, either voluntarily or involuntarily. After cancellation, a business is no longer required to pay or collect GST, and their GST number (GSTIN) is invalidated.

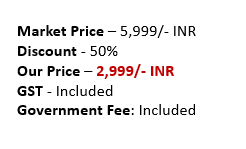

- Basic

Enquire Us

Unlocking Freedom | Streamlined GST Registration Cancellation Made Easy

GST Registration Cancellation is the process by which a GST-registered business can cancel its GST number. Here’s a comprehensive overview of the service:

GST Registration Cancellation is the procedure that ceases the existence of GST registration, either voluntarily or involuntarily. After cancellation, a business is no longer required to pay or collect GST, and their GST number (GSTIN) is invalidated.

Why GST Registration Cancellation Needed?

The cancellation of GST registration is needed in circumstances like:

- Closure or discontinuation of the business.

- Transfer of business due to amalgamation, merger, lease, etc.

- Change in the business structure (from partnership to sole, etc.).

- Death of the proprietor.

- No requirement to pay tax (turnover is below the threshold for GST).

Steps for GST Registration Cancellation

The steps involved in GST Registration Cancellation are as follows:

- Application for Cancellation: Apply for cancellation on the GST Portal by filing Form GST REG-16.

- Reason and Details: Provide a valid reason for cancellation along with the required details.

- Documents Submission: Submit any documents as required based on the reason for cancellation.

- Verification by Officer: The application is verified by a GST officer. If approved, the registration is canceled, usually within 30 days of application.

Role of a File With CA in GST Registration Cancellation

A File with CA plays a vital role in this process, providing the following services:

- Consultation: File with CA provides consultation on whether or not cancellation is beneficial or required, based on the business’s circumstances.

- Documentation: The firm assists in preparing the application and gathering all the necessary documents required for the process.

- Application Filing: File with CA can file the application on behalf of the business, ensuring all details are filled out correctly to avoid any complications.

- Liaison with GST Department: File with CA can handle any communication or queries from the GST department, ensuring a smooth cancellation process.

- Post Cancellation Assistance: A file with CA can also assist with compliance requirements post-cancellation, such as final GST return filing.

Keep in mind that GST registration cancellation is a serious decision and it’s always recommended to consult with a tax expert or a chartered accountant to understand the implications and the procedure in detail.

Is there any document needed for GST Registration Cancellation?

Yes, there are certain documents and details that are typically needed when applying for GST registration cancellation:

- Details of Inputs, Stock, or Capital Goods held in stock: The details of inputs, stock, or capital goods held in stock on the date from which cancellation is sought need to be provided.

- Details of Registered Goods and Services: You need to provide the details of any registered goods and services that you have, as well as their liability.

- Documents related to Closure of Business: If the cancellation is due to the closure of the business, appropriate proof like closure of bank account, sale deed of business premises, etc., may be needed.

- Details of Latest Tax Payment: Details of the latest tax payment made (GST Challan) are also required.

- Final GST Return: GSTR-10, the final GST return, must be filed as a statement of stock held by the taxpayer on the day before the date from which cancellation is made effective.

- Application for Cancellation: GST REG-16 is the form that needs to be filled out for the cancellation of GST.

Please note that the requirements may vary based on the nature of your business, the reason for cancellation, and the specific requirements of the GST department. Always consult with a tax expert or a chartered accountant to get the most accurate and detailed understanding of GST registration cancellation and its requirements for your specific circumstances.

Related Guides

The introduction of Section 206AB in the Income Tax Act, of 1961, has added a new layer of complexity to tax compliance

The growth of e-commerce has revolutionized the way businesses operate and consumers shop. However, with this growth comes the need for stringent

The rapid rise of cryptocurrency has prompted regulatory bodies worldwide to establish clearer tax regulations. In India, the fiscal year 2024-25 brings

ITR Services

Other Services

Documents Required

- NIL