Tax Deducted at Source (TDS) is an essential mechanism for the collection of tax in India. It requires the deductor to deduct

- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

GST Return Filings

GST Return Filing Services facilitate businesses in submitting their Goods and Services Tax (GST) returns to the government. These services help firms ensure timely, accurate submissions, often using specialized software or professionals. They manage and record sales, purchases, and taxes paid and received, thereby streamlining compliance with the government’s tax regulations and reducing errors.

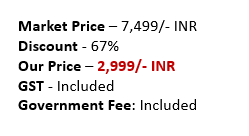

- Monthly

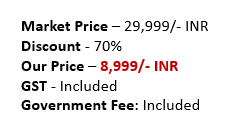

- Quarterly

- Annually

Enquire Us

Mastering GST Return Filing | Simplify Your Tax Compliance Efforts

Goods and Services Tax (GST) Return is a document containing details of income that a taxpayer is required to file with the tax administrative authorities. This document is used by tax authorities to calculate tax liability. Under GST, a registered dealer has to file GST returns, including Sales, Purchases, Output GST (on sales), and Input tax credit (GST paid on purchases).

Why GST Return Filing?

Every registered business is required to file GST returns providing details of their sales, purchases, input tax credit, and output GST. These returns help calculate a business’s tax liability. Filing GST returns on time is not only a legal requirement but also crucial for maintaining your business’s compliance and reputation.

Who Should File GST Returns?

Any business registered under the GST Act has to periodically file GST returns, irrespective of business activity or sales during the return filing period. Even a dormant business that obtained GST registration must comply with this legal requirement.

The frequency and type of return vary based on the nature of the business and the type of registration (Regular, Composition, Casual, Non-residential, etc.). Businesses typically need to file monthly (GSTR-1, GSTR-3B), quarterly (GSTR-4 for Composition Dealers), or annually (GSTR-9).

Types of GST Returns

- GSTR-1 (Monthly/Quarterly): Details of outward supplies of goods or services

- GSTR-2A (Monthly): Details of supplies auto-drafted from GSTR-1 or GSTR-5 to the recipient

- GSTR-3B (Monthly): Summary of outward supplies, Input Tax Credit (ITC) claimed, tax payable, and tax paid

- GSTR-4 (Annually): Return for a taxpayer registered under the composition levy

- GSTR-5 (Monthly): Return for a Non-Resident foreign taxable person

- GSTR-6 (Monthly): Return for an Input Service Distributor (ISD)

- GSTR-7 (Monthly): Return for authorities deducting tax at source

- GSTR-8 (Monthly): Details of supplies effected through e-commerce operator

- GSTR-9 (Annually): Annual Return for a normal taxpayer

- GSTR-10 (Once): Final Return, when registration is canceled or surrendered

- GSTR-11 (Monthly): Details of inward supplies to be furnished by a person having UIN

Key Aspects of GST Return Filing Service

- Understanding Taxpayer’s Business: The service provider needs to understand the client’s business model, the nature of transactions, and the applicable tax rates to appropriately classify the transactions.

- Document Collection: Collect necessary documents/data from clients, such as purchase and sales invoices, debit and credit notes, etc.

- Return Preparation: Preparing the GST returns based on the collected data.

- Validation & Filing: Validating the prepared return with the client and then filing the return on the GST portal using the client’s login credentials.

- Acknowledgment: Providing acknowledgment of receipt of the filed return to the client.

- Regular Updates: Keeping the client updated about the upcoming GST return filing due dates and changes in laws.

Remember, GST return filing can be complex, and missing deadlines or making errors can lead to penalties. Hence, it’s beneficial to work with a professional who provides GST return filing services.

Our GST Return Filing Services

Our team of seasoned professionals provides a comprehensive set of GST return filing services, helping you navigate the complex GST landscape with ease:

Comprehensive Consultation: Understand your GST return obligations clearly with our in-depth consultations.

GST Return Preparation: We assist in preparing and compiling all the necessary data for your GST returns

.

Filing Returns: Our team files your GST returns on your behalf, ensuring accuracy and timely submission.

Post-Filing Support: We provide complete support even after filing the returns, assisting with acknowledgments, rectifications, and any potential notices.

Related Guides

The introduction of Section 206AB in the Income Tax Act, of 1961, has added a new layer of complexity to tax compliance

The growth of e-commerce has revolutionized the way businesses operate and consumers shop. However, with this growth comes the need for stringent

The rapid rise of cryptocurrency has prompted regulatory bodies worldwide to establish clearer tax regulations. In India, the fiscal year 2024-25 brings

ITR Services

Other Services

Documents Required

To file GST returns, businesses in India typically need to prepare a range of documents based on the type of return being filed and the nature of the business. Here’s a general list of documents required for GST Return Filing Services:

- GSTIN (Goods and Services Tax Identification Number)

- Sales Invoices

- Purchase Invoices

- Input Tax Credit (ITC) Ledger

- Electronic Cash Ledger

- HSN (Harmonized System of

- Nomenclature) wise summary of

- Outward supplies

- Advances Received/Paid

- Details of Reverse Charge

- Mechanism (RCM)

- Tax Deducted at Source (TDS) Certificate

- GST Compliance Rating

- Other Supplementary Documents

- E-way Bill

Frequently Asked Questions (FAQs)

GST return filing is the process by which businesses declare their sales, purchases, input tax credit, and output GST to the government. It's an essential requirement for businesses registered under the GST regime to file periodic returns, detailing their transactions and taxes paid.

The frequency of GST return filing depends on the type of registration and the nature of the business. Typically, regular taxpayers need to file monthly (GSTR-1 and GSTR-3B) and annual returns (GSTR-9). However, composition dealers may file quarterly and annual returns.

While businesses can file GST returns independently using the government's GST portal, many opt for GST Return Filing Services to ensure accuracy, save time, and navigate the complexities of the filing process. These services often provide software tools or professional assistance.

Missing a GST return filing deadline can lead to penalties and interest. The exact amount might vary based on the duration of the delay and the type of return. It's essential to stay updated with filing dates and ensure timely submissions to avoid extra costs.

ITC is a mechanism where businesses can deduct the GST paid on their purchases from their output GST liability. During GST return filing, businesses declare their eligible ITC, which can significantly reduce their tax payable. However, there are specific conditions and documentation requirements to avail of ITC.