Tax Deducted at Source (TDS) is an essential mechanism for the collection of tax in India. It requires the deductor to deduct

- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

ITR-5 Form Filing

ITR-5 is an income tax return form that is used by firms, LLPs (Limited Liability Partnerships), AOPs (Association of Persons), BOIs (Body of Individuals), and artificial juridical persons (AJP) to file their income tax returns. It is a comprehensive form that requires taxpayers to provide detailed information about their income, deductions, and taxes payable.

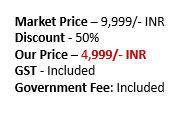

- Basic

Enquire Us

Expert Guidance And Support In Handling Tax Notices From Tax Authorities

ITR-5 is an income tax return form that is used by firms, LLPs (Limited Liability Partnerships), AOPs (Association of Persons), BOIs (Body of Individuals), and artificial juridical persons (AJP) to file their income tax returns. It is a comprehensive form that requires taxpayers to provide detailed information about their income, deductions, and taxes payable.

Here are some key features of the ITR-5 form:

- Applicability: The ITR-5 form is applicable for firms, LLPs, AOPs, BOIs, and AJPs who are not eligible to file their tax returns using the ITR-4 form.

- Sections Covered: The ITR-5 form includes various sections such as Part-A, Part B, Part C, Part D, Part E, Part F, Part G, and Schedules. Each part requires the taxpayer to provide different types of information such as personal details, income details, deductions, tax payable, etc.

- Mode of Filing: The ITR-5 form can be filed either online or offline. However, for firms that are required to get their accounts audited under section 44AB, the return must be filed online.

- Documents Required: The taxpayer is required to keep certain documents handy while filing the ITR-5 form such as the balance sheet, profit and loss account, audit report (if applicable), and other supporting documents.

- Due Date: The due date for filing the ITR-5 form is generally July 31st of the assessment year. However, for FY 2021-22, the due date has been extended to December 31st, 2022.

- Penalties: Failure to file the ITR-5 form on time can result in penalties and interest charges. The penalty for late filing is Rs. 5,000 if the return is filed after the due date but before December 31st of the assessment year. If the return is filed after December 31st, the penalty can go up to Rs. 10,000.

ITR-5 is an income tax return form that is used by firms, LLPs, AOPs, BOIs, and AJPs to file their income tax returns. The form includes various sections that require the taxpayer to provide different types of information related to income, deductions, tax payable, etc. It can be filed either online or offline, and penalties are levied for late filing.

Who is not eligible for ITR 5 Form?

The following taxpayers are not eligible to file their tax returns using the ITR-5 form:

- Individuals: Individual taxpayers are not eligible to file their tax returns using the ITR-5 form. They must file their tax returns using the appropriate form as per their income sources and other eligibility criteria.

- Companies: Companies are not eligible to file their tax returns using the ITR-5 form. They must file their tax returns using the appropriate form as per their legal status and other eligibility criteria.

- HUFs: HUFs (Hindu Undivided Families) are not eligible to file their tax returns using the ITR-5 form. They must file their tax returns using the appropriate form as per their income sources and other eligibility criteria.

- Individuals and HUFs having income from Proprietary Business or Profession: If an individual or HUF has income from a proprietary business or profession, they are not eligible to file their tax returns using the ITR-5 form. They must file their tax returns using the ITR-3 form.

In such cases, the taxpayer must file their tax returns using the appropriate form as per their income sources and other eligibility criteria.

Components of ITR 5 Form

The ITR-5 form is a comprehensive form that requires taxpayers to provide detailed information about their income, deductions, and taxes payable. The components of the ITR-5 form are as follows:

Part-A: General Information

- This part requires the taxpayer to provide their personal details such as name, address, PAN, date of birth, email address, etc.

Part-B: Gross Total Income

- This part requires the taxpayer to provide the details of their gross total income from various sources such as salary, house property, business/profession, capital gains, other sources, etc.

Part-C: Deductions and Total Taxable Income

- This part requires the taxpayer to provide details of deductions under various sections of the Income Tax Act such as sections 80C, 80D, 80G, etc., and compute the total taxable income.

Part-D: Tax Computation and Tax Payable

- This part requires the taxpayer to calculate their tax liability based on their total taxable income and the applicable tax rates.

Part-E: Other Information

- This part requires the taxpayer to provide additional information such as details of any foreign assets or income, details of tax deducted at source, etc.

Part-F: Balance Sheet and Profit and Loss Account

- This part requires the taxpayer to provide the details of the balance sheet and profit and loss account for the financial year. It is applicable to firms, LLPs, AOPs, BOIs, and AJPs.

Part-G: Other Information

- This part requires the taxpayer to provide additional information such as details of partners or members, details of the audit, details of donations, etc.

Schedules

- The ITR-5 form also includes various schedules such as Schedule-S, Schedule-HP, Schedule-CG, Schedule-OS, Schedule-BA, Schedule-IT, etc. Each schedule requires the taxpayer to provide details related to income from a particular source such as house property, capital gains, business/profession, other sources, etc.

Verification

- The taxpayer must sign and verify the ITR-5 form to confirm the accuracy of the information provided.

Annexure

- The annexure contains details of the tax payable and the tax paid.

ITR-5 form comprises several components that require the taxpayer to provide various details such as personal information, income details, deductions, tax computation, and other additional information related to the taxpayer’s balance sheet, profit and loss account, and other sources of income.

Related Guides

The introduction of Section 206AB in the Income Tax Act, of 1961, has added a new layer of complexity to tax compliance

The growth of e-commerce has revolutionized the way businesses operate and consumers shop. However, with this growth comes the need for stringent

The rapid rise of cryptocurrency has prompted regulatory bodies worldwide to establish clearer tax regulations. In India, the fiscal year 2024-25 brings

ITR Services

Other Services

Documents Required

- Monthly Purchase Bill

- Monthly Sales Bill

- Sales Return Details

- Purchase Return Details

- Tax Paid Challans for GST

- From 26AS

- Day to day Administration expenses and General expenses details

- Rental Agreement (if applicable)

- Fixed Assets Invoice Copy (if Applicable)

- Investment details made by Cash

- Investment details made through Bank

- Proof of Source of Cash In-flow and Cash Out-flowk

- Loan details from Bank or Third Party

- Outstanding receivables and payables

- Company’s Pan and two DSCs

- Details of Bank used for business transactions (Acct No, IFSC Code)

- Statement from Bank used for business transactions

- Break-up of the statement from Bank used for business transactions