- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

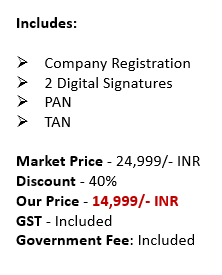

- Basic

Enquire Us

Section 8 Company

A Section 8 Company is a legal entity established for promoting charitable, social, and environmental causes. Governed by the Companies Act, 2013, Section 8 Companies offer several benefits, including limited liability, tax exemptions, and a separate legal identity. This guide will provide an overview of the Section 8 Company registration process, its structure, requirements, and taxation aspects for online Chartered Accountancy firms.

A Section 8 Company is a not-for-profit organization registered under the Companies Act, 2013, specifically under Section 8. These companies are formed to promote art, science, education, research, social welfare, charity, religion, or environmental protection. The primary objective of a Section 8 Company is to utilize its profits, if any, for the fulfillment of its objectives and not to distribute dividends among its members.

Advantages of Section 8 Companies

- Limited liability for members

- Tax exemptions and benefits

- Separate legal identity

- No minimum paid-up capital requirement

- Credibility and trustworthiness in the eyes of donors and stakeholders

Section 8 Company Registration Process

The registration process for a Section 8 Company includes the following steps:

Obtaining Digital Signature Certificate (DSC) and Director Identification Number (DIN): Obtain DSC for the proposed directors and DIN for at least two directors.

Name Reservation: Submit an application through the MCA portal to reserve a unique name for the company, ensuring that it reflects the objectives of the organization.

Preparation of Memorandum and Articles of Association: Draft the Memorandum of Association (MoA) and Articles of Association (AoA), which outline the company’s objectives, rules, and regulations.

License Application: Submit the license application to the Registrar of Companies (ROC) using Form INC-32 (SPICe) along with the MoA, AoA, and other required documents. The ROC will review the application and, if satisfied, issue the license.

Incorporation Application: Submit the incorporation application using Form INC-32 (SPICe) with the license, MoA, AoA, and other required documents.

Issuance of Incorporation Certificate: Upon verification of the submitted documents and payment of fees, the ROC will issue a Certificate of Incorporation, providing legal recognition to the Section 8 Company.

Here is a list of documents required for Section 8 Company registration:

Director’s and subscriber’s documents:

- Digital Signature Certificate (DSC) of all proposed Directors and subscribers.

- Director Identification Number (DIN) of all proposed Directors.

- Proof of identity of proposed Directors and subscribers (PAN card for Indian nationals, and passport for foreign nationals).

- Proof of residence of proposed Directors and subscribers (Aadhaar card, voter ID, passport, or driving license).

Company’s documents:

- Name reservation: RUN (Reserve Unique Name) form with at least two proposed names for the company.

- Memorandum of Association (MoA) and Articles of Association (AoA), detailing the company’s objectives, internal rules, and regulations.

- Declaration by a professional (Chartered Accountant, Company Secretary, or Cost Accountant) certifying that all requirements under the Companies Act have been fulfilled.

- Declaration by each proposed Director that they meet the criteria for being a Director as per the Companies Act.

- Declaration from the subscribers stating their intent to subscribe to the company’s shares.

Proof of registered office address:

- Ownership proof or rental/lease agreement, in case the property is rented.

- Utility bill (not older than two months) as proof of the address, like electricity, water, or gas bill.

- A No Objection Certificate (NOC) from the owner of the property, allowing the use of the premises as the registered office.

- Estimated Income and Expenditure statement for the next three years.

- A detailed note on the work the company intends to do, its objectives, and the reasons for applying for a Section 8 Company license.

- Other relevant documents, if required, based on specific situations or requirements by the MCA.

Please note that the exact list of required documents may vary slightly based on jurisdiction and specific circumstances. It is advisable to consult a professional or legal expert before proceeding with the registration process.

Frequently Asked Questions

What are the main advantages of registering a Section 8 Company?

- Some advantages include limited liability for members, separate legal entities, greater credibility, ease of fundraising, perpetual existence, and potential tax exemptions.

What is the difference between a Section 8 Company and a traditional non-profit organization like a Trust or Society?

- A Section 8 Company is governed by the Companies Act, 2013, while Trusts and Societies are governed by different Acts. Section 8 Companies have more stringent compliance requirements but offer better governance, transparency, and credibility.

What are the minimum requirements for the number of directors and shareholders in a Section 8 Company?

- A minimum of two directors is required for a private Section 8 Company and three for a public Section 8 Company. At least two shareholders are required for a private Section 8 Company and seven for a public Section 8 Company.

Can a foreign national or a Non-Resident Indian (NRI) be a director or shareholder in a Section 8 Company?

- Yes, foreign nationals and NRIs can be directors or shareholders in a Section 8 Company, subject to certain conditions and requirements.

Are there any tax exemptions or benefits available for a Section 8 Company?

- Section 8 Companies may be eligible for tax exemptions and benefits under the Income Tax Act, 1961, subject to meeting specific conditions and obtaining necessary approvals.

What is the process and timeline for registering a Section 8 Company?

- The process involves obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), reserving a company name, preparing the Memorandum of Association (MoA) and Articles of Association (AoA), and submitting the required forms and documents online. The timeline may vary depending on the specific circumstances, but it usually takes 2-4 weeks for approval.

What are the annual compliance requirements for a Section 8 Company?

- Annual compliance requirements include holding board meetings, annual general meetings, maintaining books of accounts, filing annual returns and financial statements, and fulfilling any other statutory requirements.

Are there any restrictions on the remuneration of directors or employees in a Section 8 Company?

- There are no specific restrictions on the remuneration of directors or employees in a Section 8 Company. However, the remuneration should be reasonable and in line with the company’s objectives and non-profit nature.

Can a Section 8 Company be converted into a different type of company, like a private limited or public limited company, and vice versa?

- Yes, a Section 8 Company can be converted into a private or public limited company, and vice versa, subject to meeting specific conditions and obtaining necessary approvals.

How can a Section 8 Company be wound up or dissolved?

- A Section 8 Company can be wound up voluntarily, by the tribunal, or through a fast-track process, depending on the specific circumstances. The process involves settling liabilities, disposing of assets, and filing the necessary forms and documents with the Registrar of Companies (ROC).

Related Guides

ITR Services

Other Services

Documents Required

- PAN Card

- Passport (Foreign Nationals Only)

- Voters Identity Card

- Ration Card

- Driving License

- Electricity Bill

- Telephone Bill

- Aadhaar Card

- Bank Statement

- Passport Size Photo

- Recent Utility Bill

- Business Place