Tax Deducted at Source (TDS) is an essential mechanism for the collection of tax in India. It requires the deductor to deduct

- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

pan application

PAN (Permanent Account Number) application is the process of applying for a unique identification number that is issued by the Income Tax Department of India. PAN is a 10-digit alphanumeric code that is used as a primary identity proof for individuals and entities in India.

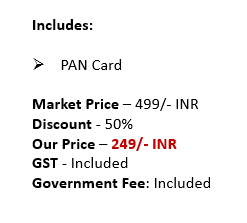

- Basic

Enquire Us

PAN Application

PAN (Permanent Account Number) application is the process of applying for a unique identification number that is issued by the Income Tax Department of India. PAN is a 10-digit alphanumeric code that is used as a primary identity proof for individuals and entities in India.

Eligibility for PAN Application

Any individual or entity that is eligible to pay taxes in India can apply for a PAN (Permanent Account Number). Here are some more details on the eligibility for PAN application:

- Individuals: Any Indian citizen, whether residing in India or outside India, and foreign nationals, who are engaged in any business or profession or have taxable income in India, can apply for a PAN card.

- Hindu Undivided Families (HUFs): HUFs that have taxable income in India can apply for a PAN card.

- Firms: Partnership firms, limited liability partnerships (LLPs), and any other type of firms that are engaged in business or profession and have taxable income in India can apply for a PAN card.

- Companies: Any type of companies, whether public or private, that are registered in India or outside India and have business operations or taxable income in India can apply for a PAN card.

- Trusts, Societies, and NGOs: Any trusts, societies, NGOs, or any other types of entities that are engaged in any business or profession and have taxable income in India can apply for a PAN card.

Types of PAN

There are two types of PAN (Permanent Account Number) cards in India:

- Physical PAN Card: This is a laminated card that is sent to the applicant’s address. The physical PAN card includes the applicant’s name, photograph, signature, PAN number, and other details. It is widely used as a primary identity proof for individuals and entities in India.

- e-PAN Card: This is a digitally signed PAN card that is sent to the applicant’s email address in a PDF format. The e-PAN card includes the same details as the physical PAN card and can be used as a valid identity proof for various purposes, such as opening bank accounts or filing income tax returns.

The e-PAN card is a recent addition to the PAN card system and was introduced in 2017 to make the PAN application process more streamlined and efficient. The e-PAN card can be downloaded from the NSDL or UTIITSL website using the applicant’s PAN number and date of birth.

Application process for PAN application

The application process for PAN (Permanent Account Number) cards in India can be done either online or offline. Here are the steps involved in both methods:

Online PAN Application Process:

- Visit the NSDL or UTIITSL website and click on the ‘Apply for new PAN card’ option.

- Select the type of application – for individuals, it is Form 49A, and for non-individuals, it is Form 49AA.

- Fill in the required details such as name, date of birth, address, and other personal details.

- Upload the scanned copies of the required documents such as proof of identity, proof of address, and photograph.

- Make the payment for the PAN application fees online.

- Submit the application and note down the acknowledgement number.

- The applicant will receive the PAN card at the address provided within the specified time.

Offline PAN Application Process:

- Download the PAN application form from the NSDL or UTIITSL website.

- Fill in the required details such as name, date of birth, address, and other personal details.

- Attach the required documents such as proof of identity, proof of address, and photograph.

- Make the payment for the PAN application fees through demand draft or cheque.

- Submit the application form and documents at the nearest PAN center or authorized agent.

- The applicant will receive the PAN card at the address provided within the specified time.

It is important to note that the PAN application fees vary based on the mode of application and the applicant’s category. Additionally, the required documents may vary based on the nature of the applicant and the type of PAN card being applied for.

Documents Required for PAN Applications

The documents required for a PAN (Permanent Account Number) application in India may vary based on the type and nature of the applicant. However, here are some commonly required documents for PAN application:

Proof of Identity: Any one of the following documents can be submitted as proof of identity:

- Aadhaar Card

- Passport

- Voter ID card

- Driving License

- Ration Card with photograph

- Arm’s License

- Photo identity card issued by the Central Government or State Government or Public Sector Undertaking

Proof of Address: Any one of the following documents can be submitted as proof of address:

- Aadhaar Card

- Passport

- Voter ID card

- Driving License

- Telephone bill

- Electricity bill

- Bank account statement

- Credit card statement

- Gas connection bill

- Water bill

- Property tax assessment order

- Rent receipt with address

- Employer’s certificate in original

Proof of Date of Birth: Any one of the following documents can be submitted as proof of date of birth:

- Aadhaar Card

- Passport

- Birth certificate issued by the Municipal Authority or any office authorized to issue Birth and Death Certificate by the Registrar of Births & Deaths

- PAN card

- Matriculation certificate

- Mark sheet of recognized board

- Driving License

- Domicile certificate issued by the Government

Photograph: A recent passport-sized photograph of the applicant is required.

Tracking PAN Transactions

It is possible to track PAN (Permanent Account Number) transactions in India using the following methods:

- Income Tax Department’s e-Filing Portal: The Income Tax Department of India provides an e-Filing portal where individuals and entities can register and track their PAN transactions. Users can log in to the portal using their PAN number and password and check the status of their income tax returns, refunds, and other transactions.

- NSDL or UTIITSL website: The NSDL and UTIITSL are the authorized agencies that issue PAN cards in India. They provide online facilities to track PAN card applications and status. Users can visit the respective websites, enter their PAN or application number, and check the status of their PAN card application or card dispatch.

- SMS or Email: The Income Tax Department also provides an SMS or email facility to track PAN transactions. Users can send an SMS or email with their PAN number and relevant keywords such as ‘ITRSTATUS’ for checking the status of their income tax return, ‘REFUNDSTATUS’ for checking the status of their refund, and ‘PANSTATUS’ for checking the status of their PAN card application.

- Bank Account Statements: PAN number is mandatory for various financial transactions such as opening a bank account, making investments, and filing tax returns. Users can track their PAN transactions by checking their bank account statements for details such as TDS deductions, interest income, and other financial transactions.

It is important to note that the specific methods for tracking PAN transactions may vary based on the nature of the transaction and the authority responsible for the transaction.

Related Guides

The introduction of Section 206AB in the Income Tax Act, of 1961, has added a new layer of complexity to tax compliance

The growth of e-commerce has revolutionized the way businesses operate and consumers shop. However, with this growth comes the need for stringent

The rapid rise of cryptocurrency has prompted regulatory bodies worldwide to establish clearer tax regulations. In India, the fiscal year 2024-25 brings

ITR Services

Other Services

Documents Required

- Proof of Identity

- Proof of Address

- Proof of Date of Birth

- Photograph