- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

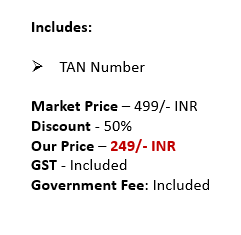

- Basic

Enquire Us

TAN Application

TAN stands for Tax Deduction and Collection Account Number. It is a unique 10-digit alphanumeric code issued by the Income Tax Department of India to persons who are required to deduct or collect tax at source on behalf of the government.

A TAN application is a process of applying for a TAN number. TAN is mandatory for businesses that are required to deduct tax at source (TDS) or collect tax at source (TCS) under the Income Tax Act, 1961. TAN is used to track and verify the TDS and TCS payments made by the business to the government.

The TAN application process involves submitting an application form (Form 49B) along with the necessary documents and paying the applicable fees. The application form can be submitted online or offline, depending on the preference of the applicant.

Once the TAN application is submitted, the Income Tax Department will verify the application and documents and issue the TAN number if everything is found to be in compliance with the rules and regulations.

Overall, TAN application is a mandatory process for businesses that are required to deduct or collect tax at source under the Income Tax Act, and it enables the government to track and verify the TDS and TCS payments made by the business.

Compliances of TAN Application

Compliance with the tax deduction and collection requirements under the Income Tax Act, 1961 is the primary compliance related to TAN application. Failure to comply with these requirements may result in penalties and fines, and may also affect the credibility and reputation of the business.

- Deduction of Tax at Source (TDS): Businesses and individuals who have a TAN number are required to deduct tax at source (TDS) on certain types of payments such as salaries, interest, rent, commission, and fees, as per the Income Tax Act, 1961. TDS must be deducted and deposited with the government within the specified timelines.

- Collection of Tax at Source (TCS): Businesses and individuals who have a TAN number are required to collect tax at source (TCS) on certain types of sales as per the Income Tax Act, 1961. TCS must be collected and deposited with the government within the specified timelines.

- Issuance of TDS/TCS Certificates: Businesses and individuals who have a TAN number are required to issue TDS/TCS certificates to the persons from whom tax has been deducted or collected, as per the Income Tax Act, 1961.

- Filing of TDS/TCS Returns: Businesses and individuals who have a TAN number are required to file TDS/TCS returns with the Income Tax Department, reporting the details of TDS/TCS deductions and collections made during the period.

Documents required for TAN Application

The documents required for TAN application are as follows:

- Proof of Identity: A valid proof of identity such as PAN card, passport, voter ID card, or driving licence.

- Proof of Address: A valid proof of address such as passport, voter ID card, driving licence, or electricity bill.

- Proof of Business: A valid proof of business such as the partnership deed, certificate of incorporation, or any other document that establishes the existence of the business.

- Bank Account Details: Details of the bank account from which TDS or TCS payments will be made.

- Payment Receipt: A receipt of the payment of the application fee.

It is important to note that the specific documents required for TAN application may vary depending on the type of business and the nature of the transaction. Additionally, the applicant may be required to provide additional documentation or undergo further verification procedures depending on the Income Tax Department’s requirements.

It is advisable to check with the Income Tax Department or a qualified expert to ensure that all necessary documents are in place before applying for TAN.

Related Guides

Documents Required

- Nill