- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

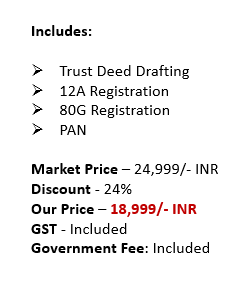

- Basic

Enquire Us

Trust Registration

A trust is a legal entity created to manage and distribute assets for specific purposes, such as charitable, educational, or religious activities. Trust registration is an essential process to ensure its legal validity and avail tax benefits. This guide will provide an overview of the trust registration process, its structure, requirements, and taxation aspects for online Chartered Accountancy firms.

What is a Trust?

A trust is a legal arrangement where a person, known as the settlor, transfers assets to the trust, managed by trustees for the benefit of beneficiaries. Trusts can be established for various purposes, such as supporting education, healthcare, religious activities, or other charitable objectives.

Types of Trusts

Trusts can be broadly classified into two categories:

Public Trusts and Private Trusts

Public Trusts: Public trusts are established for the benefit of the general public or a large section of society. These trusts generally focus on charitable, religious, or educational purposes.

Private Trusts: Private trusts are set up for the benefit of specific individuals or a small group of people, such as family members. The primary objective of a private trust is to manage and distribute assets among the beneficiaries according to the settlor’s wishes.

Trust Registration Process

The registration process for a trust includes the following steps:

Drafting the Trust Deed: The trust deed is a legal document outlining the trust’s objectives, structure, and terms. It should include details of the settlor, trustees, beneficiaries, and the trust’s property. A well-drafted trust deed is essential for the smooth functioning and management of the trust.

Submission to the Registrar: Submit the trust deed, along with the required documents, to the office of the Sub-Registrar or Registrar of Trusts in the jurisdiction where the trust’s principal office is located.

Payment of Registration Fees: Pay the registration fees as prescribed by the jurisdiction’s regulations. The fees may vary based on factors such as the trust’s property value or purpose.

Trust Registration Certificate: Upon verification of the submitted documents and payment of fees, the Registrar will issue a Trust Registration Certificate, providing legal recognition to the trust.

Taxation of Trusts

Trusts are subject to tax regulations under the Income Tax Act, 1961. Tax exemptions and benefits may be available to trusts, particularly those engaged in charitable or religious activities. It is crucial for trusts to maintain accurate financial records, file annual returns, and comply with tax regulations.

What is Public Cum-Private Trust?

A Public Cum-Private Trust is a unique type of trust that combines elements of both public and private trusts. This hybrid trust structure is designed to serve both public (charitable) purposes and private (individual or family) purposes. The trust is typically established by the settler with the intent to benefit a specific group of people, such as their family members, while also supporting charitable causes or the welfare of the community at large.

In a Public Cum-Private Trust, the trust’s assets and income are divided into two parts: one portion is allocated to serve the public purpose, and the other portion is designated for the benefit of the private beneficiaries.

The trust deed must clearly outline the objectives, structure, and terms for both the public and private components of the trust. The deed should specify the proportion of assets and income allocated to each segment and the manner in which they will be managed and distributed.

Related Guides

ITR Services

Other Services

Documents Required

- Trust deed (original and copy)

- Identification proof of the settlor and trustees (e.g., PAN card, Aadhaar card, or passport)

- Address proof of the settlor and trustees (e.g., utility bill, rental agreement, or bank statement)

- Proof of ownership or lease agreement for the trust’s property

- Passport-sized photographs of the settlor and trustees