Tax Deducted at Source (TDS) is an essential mechanism for the collection of tax in India. It requires the deductor to deduct

- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

limited liability partnership (llp)

Limited Liability Partnership (LLP) is a type of business structure in India that combines the advantages of both partnership and limited liability companies. An LLP is governed by the Limited Liability Partnership Act, 2008 and is a separate legal entity from its partners, which means that the personal assets of the partners are protected from business liabilities.

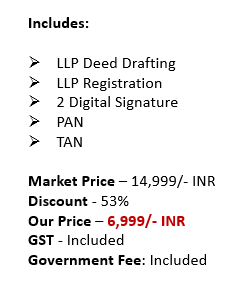

- Basic

Enquire Us

Limited Liability Partnership (LLP)

Limited Liability Partnership (LLP) is a type of business structure in India that combines the advantages of both partnership and limited liability companies. An LLP is governed by the Limited Liability Partnership Act, 2008 and is a separate legal entity from its partners, which means that the personal assets of the partners are protected from business liabilities.

The key features of an LLP are:

- Separate Legal Entity: LLP is a separate legal entity from its partners, which means that the personal assets of the partners are protected from business liabilities.

- Limited Liability: LLP offers limited liability protection to its partners, which means that the partners are not personally liable for the debts and obligations of the LLP.

- Perpetual Succession: LLP has perpetual succession, which means that the LLP continues to exist even after the retirement, death, or insolvency of its partners.

- Easy to Form: LLP is easy to form and requires a minimum of two partners. The LLP registration process is simple and can be completed online.

- Flexible Management: LLP is managed by its partners, and the partners have the flexibility to decide the management structure and profit-sharing ratio among themselves.

- Compliance Requirements: LLP is required to comply with various regulatory and legal requirements, including the filing of annual financial statements, annual returns, and other reports with the Registrar of Companies (ROC).

LLP is a popular choice among small business owners and professionals who want to enjoy the benefits of limited liability protection while retaining the flexibility of a partnership. However, it is important to ensure compliance with all the applicable laws and regulations to avoid penalties and legal issues.

Limited Liability Partnership (LLP) in Comparison to Other Types

Advantages/Disadvantages | Limited Liability Partnership (LLP) | Sole Proprietorship | Partnership | Private Limited Company |

Liability | Limited Liability for Partners | Unlimited Personal Liability | Unlimited Personal Liability | Limited Liability for Shareholders |

Separate Legal Entity | Yes | No | No | Yes |

Taxation | Pass-through taxation | Personal Income Tax | Pass-through taxation | Separate Corporate Tax |

Fundraising | Restrictions on Fundraising | Personal Funds and Loans | Limited to Partners and Borrowings | Issue of Shares and Borrowings |

Management | Flexibility in Management | Sole Decision-Making Authority | Shared Decision-Making Authority | Separation of Ownership and Management |

Compliance Requirements | Lower Compliance Requirements | Minimal Compliance Requirements | Moderate Compliance Requirements | High Compliance Requirements |

Credibility and Trust | Greater Credibility and Trust | Low Credibility and Trust | Moderate Credibility and Trust | High Credibility and Trust |

Ownership Transfer | Easy Transfer of Ownership | No Transfer of Ownership | Complicated Transfer of Ownership | Easy Transfer of Ownership |

Audit Requirement | Audit Requirement | No Audit Requirement | Audit Requirement | Audit Requirement |

Number of Partners/Members | Minimum 2 Partners/Members | One Person | Minimum 2 Partners/Members | Minimum 2 Directors and 2 Shareholders |

LLP Registration Requirements

To register a Limited Liability Partnership (LLP) in India, the following requirements must be fulfilled:

- Minimum Requirements: The LLP must have a minimum of two partners, and at least two Designated Partners (DPs). One of the DPs must be a resident of India.

- Digital Signature Certificates (DSC) and Director Identification Numbers (DIN): All the designated partners must obtain their DSC and DIN.

- Name Approval Application: A name approval application needs to be submitted to the Registrar of Companies (ROC) to obtain the approval of the proposed LLP name. The name should not be identical or similar to the name of any existing company or LLP.

- Preparation of LLP Agreement: The partners must prepare the LLP agreement which specifies the terms and conditions of the LLP including the capital contribution, profit-sharing ratio, and other details.

- Incorporation Application: The LLP incorporation application must be submitted to the ROC along with the necessary fees and documents, including the LLP agreement, address proof of the registered office, and identity and address proof of the designated partners.

- Certificate of Incorporation: If the ROC is satisfied with the application and the documents, it will issue a Certificate of Incorporation for the LLP. The LLP can start its operations after receiving the Certificate of Incorporation.

- PAN and TAN Application: After receiving the Certificate of Incorporation, the LLP must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) with the Income Tax Department.

- Bank Account Opening: The final step is to open a bank account in the name of the LLP with a scheduled bank.

Forms for LLP Registration

The following forms need to be filed for the registration of a Limited Liability Partnership (LLP) in India:

- Form 1: This is the form for the incorporation of an LLP, and it contains basic details such as the proposed name of the LLP, registered office address, details of the partners and designated partners, etc.

- Form 2: This form contains information regarding the appointment of designated partners and their consent to act as designated partners.

- Form 3: This form contains the information regarding the LLP agreement and must be filed within 30 days of incorporation.

- Form 4: This form contains the details of the partners and changes in the partners’ information after incorporation.

- Form 11: This is an annual return form, which must be filed every year with the Registrar of Companies (ROC). The form contains the details of the LLP’s financial statements, partners’ details, etc.

- Form 8: This is a statement of account and solvency form, which must be filed annually with the ROC. The form contains the details of the LLP’s assets and liabilities and the solvency status of the LLP.

It is important to ensure that all the forms are filed accurately and within the prescribed timelines to avoid any penalties or legal issues.

How File With CA can help in Limited Liability Partnership (LLP) registration process

A Chartered Accountant (CA) can play a crucial role in the Limited Liability Partnership (LLP) registration process. Here are some ways in which an File With CA can help:

- Guidance on Legal Compliances: File With CA can guide you through the legal compliances and procedures required for registering an LLP. They can provide valuable advice on the documentation required, the registration fees, and the necessary government approvals.

- Drafting of LLP Agreement: The LLP agreement is a crucial document that outlines the roles, responsibilities, and profit-sharing arrangements between the partners. File With CA can help in drafting a comprehensive LLP agreement that covers all aspects of the partnership.

- Compliance with Tax Laws: File With CA can help you comply with the tax laws applicable to LLPs. They can assist in obtaining the necessary tax registrations, such as GST registration, and provide advice on the tax implications of the partnership agreement.

- Audit and Accounting Services: A CA can provide audit and accounting services to ensure that the LLP maintains accurate financial records and complies with accounting standards. They can also assist in preparing financial statements and filing tax returns.

- Advisory Services: File With CAcan provide advisory services on various aspects of the LLP’s operations, such as financial planning, risk management, and strategic decision making. They can help in identifying opportunities for growth and optimising the LLP’s financial performance.

File With CA can help in the LLP registration process by providing guidance on legal compliances, drafting of LLP agreement, compliance with tax laws, audit and accounting services, and advisory services.

Related Guides

The introduction of Section 206AB in the Income Tax Act, of 1961, has added a new layer of complexity to tax compliance

The growth of e-commerce has revolutionized the way businesses operate and consumers shop. However, with this growth comes the need for stringent

ITR Services

Other Services

Documents Required

- PAN Card

- Passport (Foreign Nationals Only)

- Voters Identity Card

- Ration Card

- Driving License

- Electricity Bill

- Telephone Bill

- Aadhaar Card

- Bank Statement

- Passport Size Photo

- Recent Utility Bill

- Business Place