- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

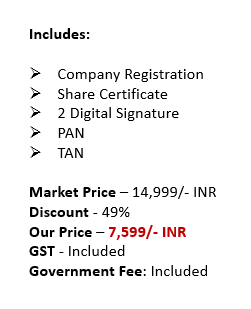

- Basic

Enquire Us

One person Comapny (opc)

One Person Company (OPC) is a type of company structure that was introduced by the Companies Act, 2013 in India. It is a company that has only one person as its member and shareholder, who also acts as the sole director of the company.

OPCs provide the benefits of a private limited company, such as limited liability protection, while also allowing for greater control and ownership by a single person. This type of company structure is ideal for small business owners and entrepreneurs who want to establish a separate legal entity for their business without having to involve any partners or co-owners.

OPCs are required to have a registered office address, a nominee director in case of the death or incapacity of the sole member, and must file annual returns with the Registrar of Companies. They are also subject to the same regulatory compliance and taxation requirements as other types of companies in India.

The key features of an OPC are:

- Single Ownership: OPC is owned and controlled by a single person who acts as both the shareholder and the director of the company.

- Limited Liability: OPC offers limited liability protection to its owner, which means that the owner’s personal assets are not at risk in case of business losses or liabilities.

- Minimum Authorised Capital: The minimum authorised capital for an OPC is Rs. 1 lakh.

- Nominee Director: An OPC is required to appoint a nominee director who can take over the management of the company in case of the owner’s death or incapacity.

- Compliance Requirements: OPC is required to comply with various regulatory and legal requirements, including the filing of annual financial statements, annual returns, and other reports with the Registrar of Companies (ROC).

OPC is a popular choice among small business owners and entrepreneurs who want to enjoy the benefits of limited liability protection while retaining complete control over their business. However, it is important to ensure compliance with all the applicable laws and regulations to avoid penalties and legal issues.

One Person Company (OPC) is best for those who?

One Person Company (OPC) is best suited for individuals who want to start their own business and have complete control over it without having to involve any partners or co-owners. It is ideal for those who:

- Want to start a business with limited liability protection, as OPCs provide a separate legal entity from the owner, protecting their personal assets.

- Want to have complete control and decision-making power over their business without any interference from partners or co-owners.

- Want to establish credibility and professionalism in the market by registering their business as a separate legal entity.

- Want to enjoy the benefits of a private limited company, such as access to funding, legal protection, and tax benefits.

- Want to avoid the legal and financial complexities of forming and managing a partnership or LLP.

Overall, OPCs provide a great option for entrepreneurs who want to start a business on their own and enjoy the benefits of a separate legal entity, while also having complete control over the business.

Documents Required for One-Person Company (OPC) Registration

It is important to ensure that all the documents are accurate and complete to avoid any delays or rejections in the OPC registration process. It is advisable to seek professional assistance to ensure compliance with all the regulatory requirements. The documents required for One Person Company (OPC) registration in India are as follows:

- Director Identification Number (DIN) and Digital Signature Certificate (DSC) of the proposed director(s).

- Name Approval Application: A name approval application needs to be submitted to the Registrar of Companies (ROC) to obtain approval of the proposed company name. The name should not be identical or similar to the name of any existing company.

- Memorandum of Association (MOA) and Articles of Association (AOA) of the company: MOA and AOA are legal documents that define the scope and objectives of the company and its rules and regulations.

- Affidavit and Consent of the proposed director(s): The proposed director(s) are required to submit an affidavit and consent in the prescribed format, declaring their eligibility and willingness to act as the director of the proposed OPC.

- Proof of Registered Office Address: The OPC must have a registered office address in India. The proof of address can be in the form of a rent agreement, lease deed or utility bill of the premises.

- Certificate of Incorporation: If the proposed OPC has been converted from a sole proprietorship or partnership firm, a certificate of incorporation or registration of the firm must be submitted.

- NOC from the owner of the registered office address: If the registered office address is rented or leased, a no-objection certificate (NOC) from the owner of the premises is required.

Comparison Table Of One Person Company And Private Limited Company

Both OPCs and Private Limited Companies have their advantages and disadvantages, and the choice between the two depends on the specific needs and goals of the business owner. While OPCs are ideal for small business owners who want to have complete control over their business, Private Limited Companies are suitable for larger businesses that require more members, capital, and compliance.

|

Feature |

One Person Company (OPC) |

Private Limited Company |

|

Number of Members |

Only one member (shareholder) |

Minimum 2 members, Maximum 200 |

|

Legal Entity Status |

Separate legal entity |

Separate legal entity |

|

Liability Protection |

Limited liability protection |

Limited liability protection |

|

Minimum Capital Requirement |

No minimum capital requirement |

Minimum capital requirement of INR 1 Lakh or as prescribed |

|

Board Meetings |

At least 1 board meeting per year |

At least 4 board meetings per year |

|

Annual Compliance |

Less compliance requirements |

More compliance requirements |

|

Transfer of Ownership |

Not allowed |

Allowed with restrictions |

|

Name Protection |

Name protection for the company |

Name protection for the company |

|

Taxation |

Taxed at a flat rate of 25% |

Taxed at a flat rate of 25% |

Related Guides

ITR Services

Other Services

Documents Required

- PAN Card

- Passport

- Voters Identity Card

- Ration Card

- Driving License

- Electricity Bill

- Telephone Bill

- Aadhaar Card

- Bank Statement

- Sale Deed Copy

- Lease / Rent Agreement

- MOA Subscriber Sheet

- AOA Subscriber Sheet

- Passport Size Photo

- Recent Utility Bill

- Business Place