- Home

- Income Tax

- GST

- Registration

- Sole Proprietorship Registration

- Section 8 Company

- Partnership Firm Registration

- Nidhi Company Registration

- Private Limited Company Registration

- Trust Registration

- One Person Company Registration (OPC)

- Hindu Undivided Family (HUF)

- Limited Liability Partnership (LLP)

- PF Registration

- Professional Tax

- Digital Signature

- FSSAI Registration

- TAN Application

- Import Export Code (IEC)

- PAN Application

- MSME Registration

- Start Up India Registration

- Professional Tax

- Accounting

- Blog

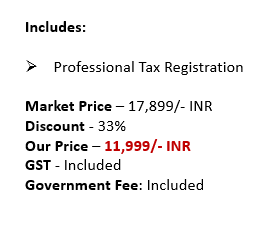

- Basic

Enquire Us

Professional Tax

Professional tax is a state-level tax that is imposed on individuals and entities engaged in various professions, trades, and employment. It is governed by the respective state governments in India and is applicable to all types of professions, such as doctors, lawyers, accountants, engineers, and consultants, among others.

The rate of professional tax varies from state to state, and the tax amount is typically deducted by the employer from the employee’s salary and paid to the state government. Self-employed professionals are required to pay the professional tax directly to the state government.

Professional tax is levied on a periodic basis, such as monthly or annually, and the due date for payment of professional tax varies from state to state. Failure to pay the professional tax within the prescribed due date may result in penalties or fines.

The professional tax collected by the state government is primarily used for the development of the state and for various welfare schemes. Some states also offer exemptions and deductions on professional tax for certain categories of individuals, such as senior citizens, disabled persons, and women.

Professional Tax Registration and Returns

Professional tax registration and returns are important aspects of complying with the professional tax laws in India. Here is some important information about professional tax registration and returns:

Professional Tax Registration:

- Registration Requirement: Every person or entity that is liable to pay professional tax is required to register with the respective state government and obtain a professional tax registration certificate.

- Registration Process: The registration process may vary from state to state, but generally, an application is required to be submitted along with the required documents, such as PAN card, ID proof, address proof, and proof of profession.

- Certificate Issuance: After the application is processed and approved, the state government issues a professional tax registration certificate.

Professional Tax Returns:

- Filing Requirement: Every person or entity that is liable to pay professional tax is required to file professional tax returns as per the prescribed due dates.

- Filing Process: The filing process may vary from state to state, but generally, the professional tax return is required to be filed online or manually.

- Due Date: The due date for filing professional tax returns varies from state to state, and late filing may attract penalties and fines.

- Payment: The professional tax payment is typically made along with the filing of the professional tax return.

Professional Tax Exemptions

Professional tax exemptions are offered by some states in India for certain categories of individuals, such as:

- Senior citizens: Some states offer professional tax exemptions for senior citizens who have crossed a certain age limit, such as 60 or 65 years.

- Disabled persons: Some states offer professional tax exemptions for persons with disabilities who have a disability certificate issued by the state government.

- Women: Some states offer professional tax exemptions for women employees, especially for those who are the sole breadwinners of their families.

- Unemployed individuals: Some states offer professional tax exemptions for individuals who are unemployed for a certain period and are actively seeking employment.

- Government employees: Some states offer professional tax exemptions for employees of the state or central government, including defence personnel.

It is important to note that the professional tax exemptions may vary from state to state, and the eligibility criteria may differ as well.

Individuals should check the applicable laws and regulations of their state and consult with a legal or financial professional for any questions or clarifications related to professional tax exemptions.

Professional Tax is applicable for whom?

- Salaried employees: Professional tax is typically deducted by the employer from the salary of the employee and paid to the state government.

- Self-employed professionals: Self-employed professionals, such as doctors, lawyers, accountants, and consultants, among others, are required to pay professional tax directly to the state government.

- Business entities: Business entities, such as proprietorships, partnerships, limited liability partnerships (LLPs), and companies, are required to pay professional tax directly to the state government.

- Freelancers: Freelancers who earn income from their profession or trade are also liable to pay professional tax.

- Employers: Employers who employ individuals or engage in business activities are required to deduct and pay professional tax on behalf of their employees or themselves.

Professional Tax Vs Income Tax

Aspect | Professional Tax | Income Tax |

Definition | State-level tax on professions, trades, and employment | Central government tax on income earned |

Applicability | Applicable in most states of India | Applicable throughout India |

Basis of tax | Based on the income or turnover of the individual or entity | Based on the income earned by the individual |

Rate | Varies from state to state, typically up to Rs. 2,500 per annum | Based on income slabs, ranging from 0% to 30% |

Collection | Typically collected by the employer from the employee’s salary and paid to the state government | Paid by the individual or entity directly to the central government |

Deductions | Some states offer exemptions and deductions for certain categories of individuals | Several deductions and exemptions are available, such as those for investments, medical expenses, and home loans |

Purpose | Primarily used for the development of the state and for various welfare schemes | Primarily used for the development of the country and for various welfare schemes |

Compliance Of Professional Tax

Compliance of professional tax is an important aspect that individuals and entities engaged in various professions and trades should adhere to. Here are some important compliance requirements related to professional tax:

- Registration: Every person or entity who is liable to pay professional tax is required to register with the respective state government and obtain a professional tax registration certificate.

- Payment: The professional tax amount is typically deducted by the employer from the employee’s salary and paid to the state government on a periodic basis. Self-employed professionals and business entities are required to pay the professional tax directly to the state government.

- Due date: The due date for payment of professional tax varies from state to state, and late payment may attract penalties and fines.

- Filing of returns: Every person or entity that is liable to pay professional tax is required to file professional tax returns as per the prescribed due dates.

- Maintenance of records: Individuals and entities should maintain proper records and documentation related to professional tax payments and filings for a minimum period of 5 years.

- Compliance with regulations: Individuals and entities should comply with the applicable laws and regulations related to professional tax, and ensure that all the necessary documents are submitted accurately and in a timely manner.

Related Guides

Documents Required

- Nill