New GST Registration Documents for Proprietorship | Updated Guide[2023]

Goods and Services Tax (GST) has brought a revolution in the Indian taxation system by integrating several state and central taxes into a unified tax system. If you are a proprietor planning to step into the business world, registering for GST is a crucial step. This article provides a detailed walkthrough of the essential documents required for GST registration for a proprietorship firm.

1. Introduction to Proprietorship and GST

Contents

- 1. Introduction to Proprietorship and GST

- 2. Prerequisite: PAN and Aadhaar Card

- 3. Principal Place of Business Documents

- 4. Bank Account Details

- 5. Photographs

- 6. Digital Signature

- 7. Proof of Business Registration

- 8. Additional Documents (if applicable)

- 9. Mobile Number & Email ID

- 10. Conclusion and Important Points

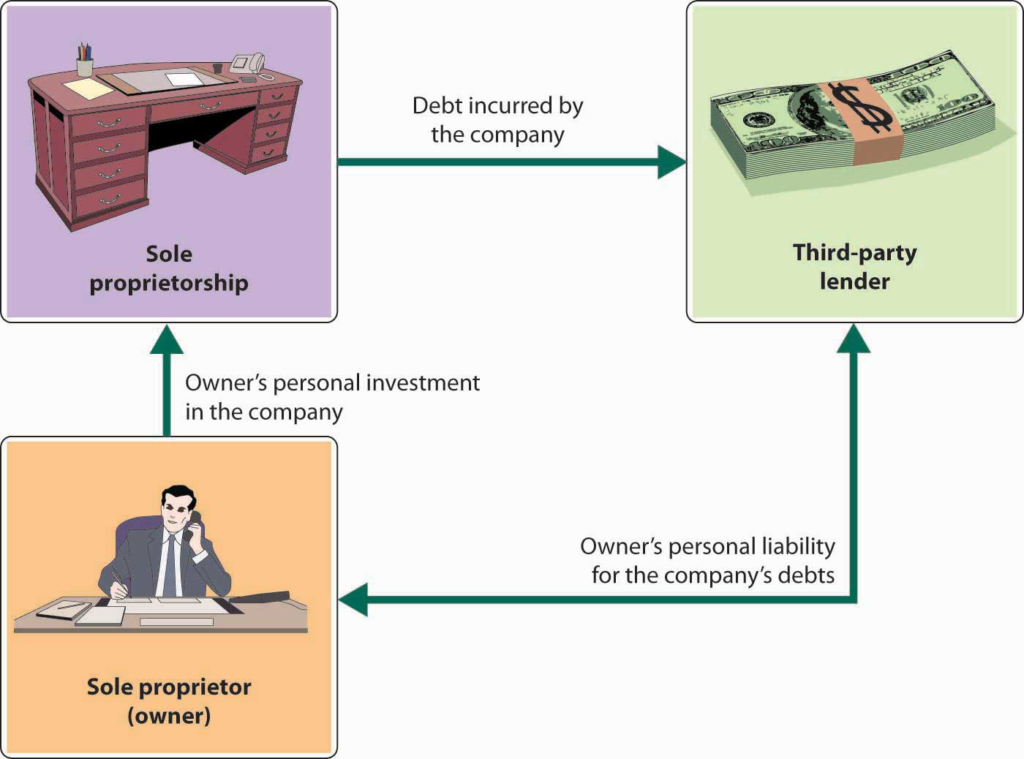

A proprietorship is the simplest form of business where the owner is solely responsible for all aspects of the business, including its debts. In the GST context, a proprietor and a proprietorship are treated as the same legal entity. Thus, the PAN of the proprietor is used for the GST registration.

2. Prerequisite: PAN and Aadhaar Card

Before diving into the GST-specific documents, it’s imperative to note that:

- PAN (Permanent Account Number): Every proprietor must have a valid PAN, as it’s the primary document for tax and identification purposes.

- Aadhaar Card: A valid Aadhaar card is essential for verification and authentication purposes.

3. Principal Place of Business Documents

Your principal place of business is where you conduct major business operations and maintain books of accounts. The following are the documents required:

- Ownership Deed or Lease/Rent Agreement: If the property is owned, a copy of the ownership deed is needed. In the case of rental/leased properties, a copy of the lease or rent agreement should be provided.

- Electricity Bill: A recent electricity bill of the said premise.

- NOC (No Objection Certificate): If the premise is rented, an NOC from the landlord is beneficial, although not always mandatory.

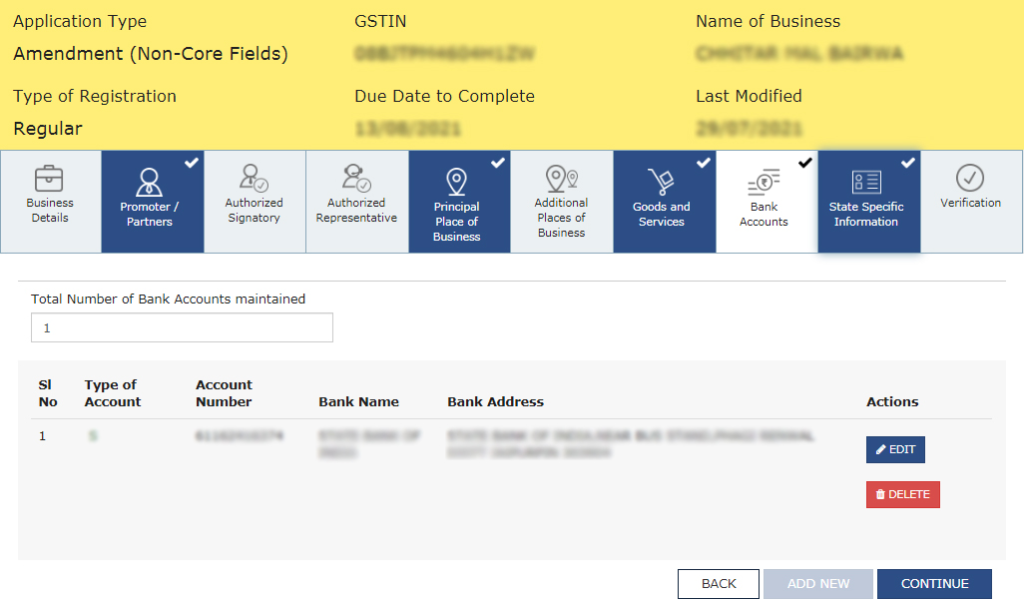

4. Bank Account Details

Proof of bank account is essential. This can be:

- Bank Statement: A copy of a recent bank statement with the name of the proprietor, address, and current transactions.

- Canceled Cheque: A canceled cheque with the name of the proprietor printed on it can also suffice.

5. Photographs

- Proprietor’s Photograph: A recent, passport-sized photograph of the proprietor.

6. Digital Signature

Although proprietorship firms can typically authenticate using an Aadhaar-based e-signature, if you have a Digital Signature Certificate (DSC), it can be used for authentication on the GST portal.

7. Proof of Business Registration

For businesses that were established before the GST era and are already in possession of business registration or any other equivalent business registration proof, a copy of the same should be provided.

8. Additional Documents (if applicable)

- Letter of Authorization/Board Resolution: If you’re appointing an authorized signatory, a letter of authorization or board resolution is necessary.

- Other Licenses/Registrations: Depending on the nature of your business, licenses like Shop & Establishment, Udyog Aadhaar, or any industry-specific licenses should be provided.

9. Mobile Number & Email ID

A valid Indian mobile number and email ID are necessary for OTP verification and future correspondence regarding GST.

10. Conclusion and Important Points

- Verification Process: Once the application for GST registration is submitted with all required documents, it undergoes a verification process. Any discrepancies or clarifications will be communicated, and it’s essential to respond promptly.

- Avoid Delays: Ensure that all provided documents are recent, valid, and clear to read. This can expedite the registration process.

- UIN Holders: If you hold a Unique Identification Number (UIN) due to being a specialized agency of the UN or any Multilateral Financial Institution and Organization, you need to provide a copy of the same.

To wrap up, GST registration for a proprietorship is straightforward, but attention to detail is crucial. Having the right documents in place ensures a smooth registration process, allowing you to commence your business operations without hiccups.