How To Activate Cancelled GST Registration After One Year: A Detailed Insight

The Goods and Services Tax (GST) introduced in India marked a significant transformation in the taxation landscape. In line with fostering a transparent and unified tax structure, the GST framework, however, also presents its set of complexities. One such intricacy that many taxpayers face is the cancellation of their GST registration. If your GST registration is cancelled and you wish to reactivate it, especially after a lapse of one year, it’s essential to know the steps involved and the importance of the same.

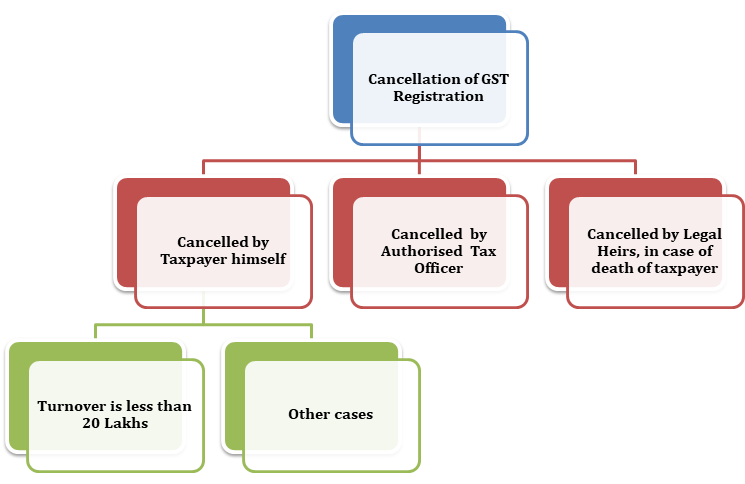

Why might GST Registration be Cancelled?

Contents

Before diving into the reactivation process, it’s vital to understand why a GST registration might be cancelled in the first place. The reasons can range from the taxpayer not filing returns continuously, false information provided during registration, or the taxable person is no longer liable to pay GST.

How to Reactivate Cancelled GST Registration?

Reactivate a GST registration after a year can be a tad challenging. However, with the right knowledge and approach, it’s certainly possible.

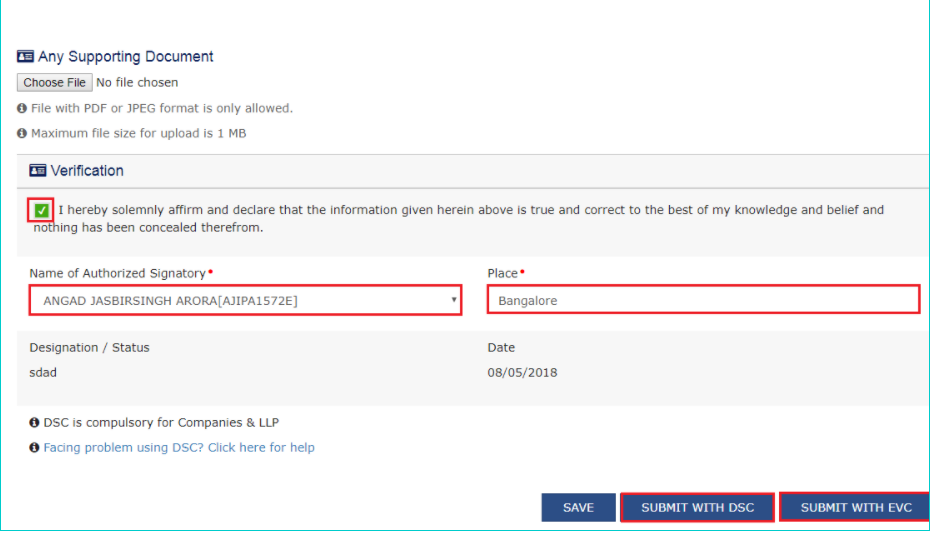

- Application for Revocation: Firstly, you should file an application for the revocation of cancellation. This needs to be done in Form GST REG-21. The application should be made to the concerned GST officer within 30 days of the cancellation order.

- Reason for Revocation: It’s crucial to provide a valid reason for the revocation. If the original cancellation was due to non-compliance, make sure you have rectified the mistake and are now in full compliance.

- GST Officer’s Decision: Once the application is submitted, the concerned GST officer will decide on the validity of the revocation. If satisfied, the officer will revoke the cancellation, allowing you to carry on with your business activities under GST.

- Potential Rejection & Appeal: There’s a possibility that the GST officer might reject the revocation application. In such cases, the rejection reasons will be communicated in Form GST REG-05. If you believe the rejection to be unjust, you can appeal against the decision within 3 months of the date of the order.

Importance of Reactivating GST Registration:

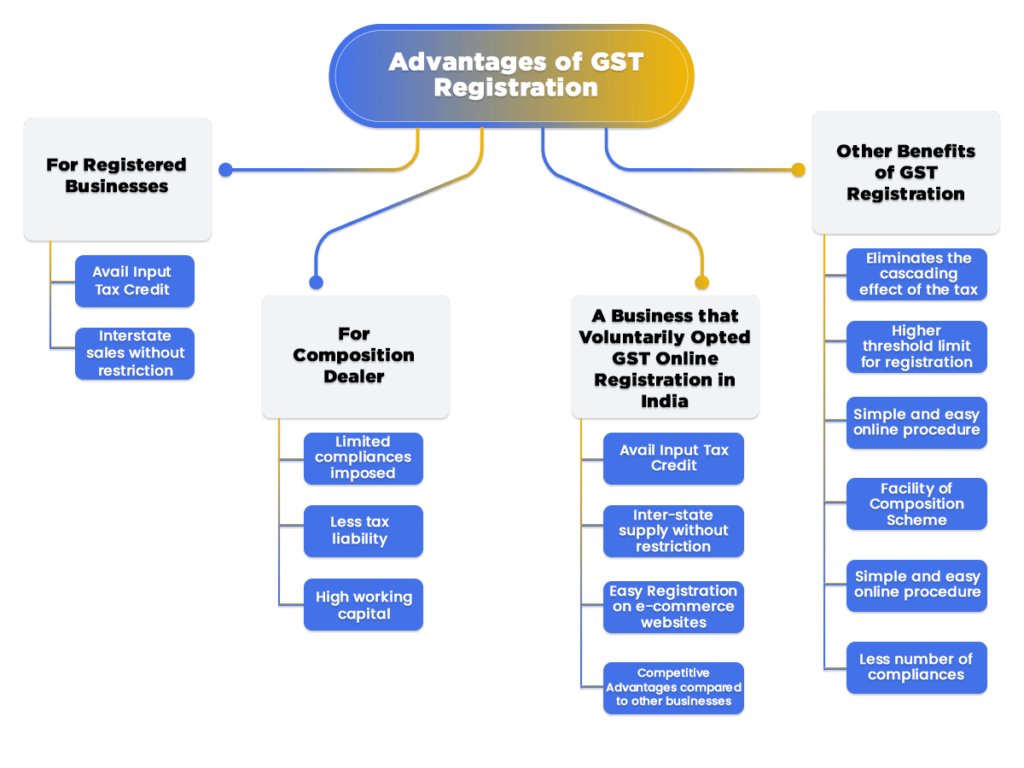

- Legal Compliance: Operating without a valid GST registration (when required) is a violation of the law. Reactivating ensures you’re compliant and avoids penalties.

- Business Reputation: A valid GST registration adds credibility to your business. Clients and vendors may prefer dealing with GST registered entities, especially in B2B transactions.

- Avail Input Tax Credit: One of the primary advantages of GST is the seamless flow of input tax credit (ITC). If your registration is cancelled, you cannot avail ITC, which can result in higher costs.

- Smooth Business Operations: For businesses involved in inter-state transactions, a valid GST registration is crucial. Without it, inter-state commerce can be hindered, impacting your business operations.

Latest Update

The government is constantly striving to simplify the GST processes for taxpayers. As of the last update, there have been considerations to increase the time limit for filing the revocation application, allowing businesses more leeway. However, it’s imperative to stay updated with the GST portal and notifications for any changes.

Conclusion

Navigating the GST framework requires diligence and compliance. If your GST registration has been cancelled and you wish to revive it after a year, understanding the steps involved and the rationale behind them is crucial. Reactivating your GST registration ensures that you remain on the right side of the law, can avail the numerous benefits offered by the GST regime, and can continue business operations without hindrance.

To ensure smooth reactivation, consider seeking advice from a GST consultant. Their expertise can guide you through the process and provide insights tailored to your specific situation.

- The Ultimate Guide to GST Reverse Charge Mechanism (RCM): Demystifying Notification 13/2017

- GST on Doctor-Director Remuneration: When Does RCM Apply?

- File Consumer Complaint Against Flipkart & Get Refund | Scam Safety in 2026

- Liquor License Costs in India: top 3 States Cost Analysis for 2026

- Karuvoolam IFHRMS: How to Log In and Download Your Payslip (2026 Guide)

- Depreciation on Software as per Income Tax Act: A CA’s Guide for FY 2025-26

Leave a Reply