What Is Acknowledgment Number In ITR (Income Tax Return) | Understand The Basics

Filing income tax returns is an essential obligation for every eligible taxpayer in India. After submitting your Income Tax Return (ITR) online, you receive an acknowledgment from the Income Tax Department known as the “Acknowledgment Number.” This unique identifier serves as proof of successful ITR submission and is vital for future reference and communication with the tax authorities. In this article, we will delve into the significance of the acknowledgment number in ITR, its components, and frequently asked questions to provide taxpayers with a comprehensive understanding of this critical aspect of the tax filing process.

The acknowledgment number in ITR is a unique identification code that confirms the successful submission of your income tax return. It is an essential document that serves as proof of compliance with tax regulations and is required for various financial transactions and legal purposes. The acknowledgment number provides taxpayers with peace of mind, knowing that their ITR has reached the Income Tax Department and is being processed.

Components of the Acknowledgment Number

Contents

- Assessment Year (AY): The assessment year represents the financial year for which you are filing your income tax return. For instance, if you are filing for the financial year 2022-2023, the corresponding assessment year will be 2023-2024.

- Unique Sequence Number: The unique sequence number is a combination of alphabets and numbers that distinguishes your ITR from others filed during the same assessment year. It helps in tracking and organizing tax returns in the IT Department’s database.

- Date and Time of ITR Filing: The acknowledgment number also includes the date and time of filing your ITR. This timestamp is essential for verifying the timely submission of your tax return.

- 15-Digit Acknowledgment Number: The acknowledgment number is a 15-digit alphanumeric code that combines the assessment year, unique sequence number, and date of filing. This code uniquely identifies your ITR submission.

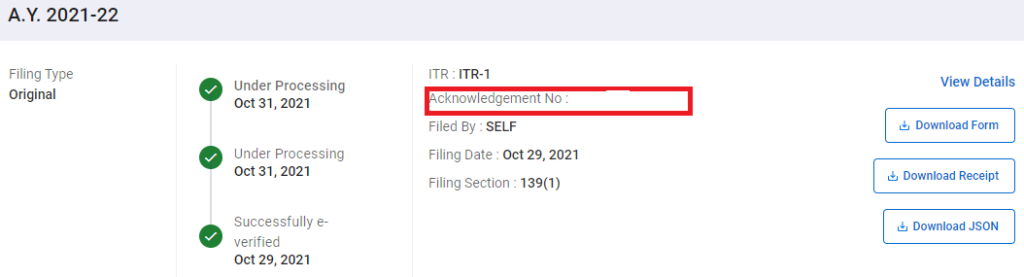

How to Obtain the Acknowledgment Number

Filing ITR Online: To obtain the acknowledgment number, you need to file your income tax return online on the official website of the Income Tax Department or through authorized e-filing portals. After completing the e-filing process, you will receive the acknowledgment number as confirmation.

E-Verification Process: Once you have filed your ITR online, it is essential to e-verify the return to complete the filing process. E-verification can be done through various methods, such as net banking, Aadhaar OTP, or sending a signed physical copy of ITR-V to the Centralized Processing Centre (CPC).

Retaining and Using the Acknowledgment Number

Proof of Filing ITR: The acknowledgment number acts as evidence that you have filed your income tax return on time. Always keep a copy of the acknowledgment for your records and future reference.

Tracking Tax Refunds and Communication with the IT Department: In case you are eligible for a tax refund, the acknowledgment number will be required to track the status of your refund. Additionally, if the Income Tax Department needs to communicate with you regarding your ITR, the acknowledgment number will be used as a reference in their correspondence.

Common FAQs on Acknowledgment Numbers in ITR

Q1. Can I file my income tax return without an acknowledgment number?

A: No, the acknowledgment number is generated upon the successful filing of your income tax return. It serves as proof of submission and is necessary to complete the filing process.

Q2. How long does it take to receive the acknowledgment number after filing ITR online?

A: The acknowledgment number is usually generated instantly after successfully filing your ITR online. However, in some cases, it may take a few minutes to be generated, depending on the server load and internet connectivity.

Q3. What should I do if I do not receive the acknowledgment number after filing ITR online?

A: If you do not receive the acknowledgment number after filing ITR, wait for a few minutes and check your registered email or e-filing account for any updates. If you still do not receive it, try filing again or contact the Income Tax Department helpline for assistance.

Q4. Can I use the acknowledgment number to file revised returns or rectify any errors in my original ITR?

A: Yes, you can use the acknowledgment number to file revised returns if you need to make corrections or update any details in your original tax return.

Conclusion

The acknowledgment number in the Income Tax Return (ITR) is a vital aspect of tax filing, serving as proof of submission and facilitating e-verification of the return. It plays a pivotal role in tracking the ITR status and ensures taxpayers comply with their tax obligations.

Understanding the significance of the acknowledgment number and knowing how to obtain it is essential for a smooth and efficient tax filing process. By following the guidelines provided in this detailed awareness guide, taxpayers can successfully file their ITRs and stay compliant with tax regulations.