How to Change Proprietor Name in GST Portal | 5 Easy Steps [2024]

When it comes to managing your Goods and Services Tax (GST) account in India, keeping your information up to date is crucial. One of the changes that businesses might need to make is updating the name of the proprietor on the GST portal. This guide will help you navigate the process smoothly and ensure that your GST-related documents are accurate and compliant, whether it’s due to a legal name change or any other reason.

Understanding the Necessity for Change Proprietor Name in GST Portal

Contents

- Understanding the Necessity for Change Proprietor Name in GST Portal

- Pre-Requisites for Changing Proprietor Name

- Step 1: Gathering Necessary Documents

- Step 2: Logging into the GST Portal

- Step 3: Navigating to the Edit Section

- Step 4: Updating Proprietor’s Name

- Step 5: Verification and Submission

- Step 6: Acknowledgement and Processing

- Step 7: Confirmation

- Important Points to Remember

- Conclusion

Before initiating the process, it’s important to understand the circumstances under which a change in the proprietor’s name is permissible:

- Legal name change of the proprietor

- Corrections in the name due to spelling errors or typos

- Changes following marriage or divorce

- Any other valid legal reasons

Pre-Requisites for Changing Proprietor Name

- Legal document proof of name change

- Access to the GST portal with administrator credentials

- The latest version of the Digital Signature Certificate (DSC) for the proprietor, if applicable

Step 1: Gathering Necessary Documents

The first step is to gather the legal documents that validate the change of name. This could include:

- Government gazette notification

- A passport showing the new name

- Updated Aadhaar Card

- Marriage certificate (in case of change due to marriage)

- Any other government-issued document that certifies the change of name

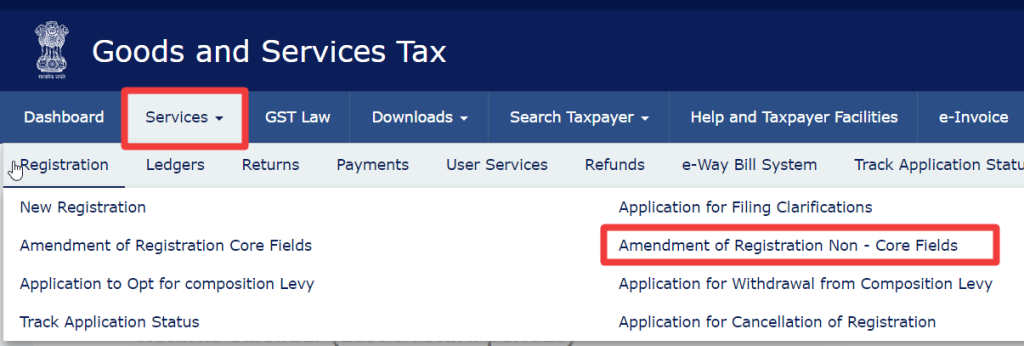

Step 2: Logging into the GST Portal

- Visit the official GST portal (www.gst.gov.in).

- Log in with your credentials, which include your username and password.

- Once logged in, navigate to the ‘Services’ tab.

- Under ‘Services’, select ‘Registration’ and then ‘Amendment of Registration Non-Core Fields’.

Step 4: Updating Proprietor’s Name

- In the ‘Amendment of Registration Non-Core Fields’ section, find the ‘Proprietor’s Information’ tab.

- Click on the edit (pencil icon) button next to the name of the proprietor.

- Enter the new name of the proprietor as it appears on your legal documents.

- Attach the supporting documents that verify the change of name.

Step 5: Verification and Submission

- After entering the new name and attaching documents, you’ll need to verify the changes.

- If you use a Digital Signature Certificate (DSC), make sure it is updated with the new name and affix it to validate the changes.

- For those who use an Electronic Verification Code (EVC), a code will be sent to the registered mobile number and email for verification purposes.

Step 6: Acknowledgement and Processing

- Upon submission, you will receive an acknowledgment in the form of an Application Reference Number (ARN).

- The GST officer might call for additional documents or clarification.

- Once verified and approved by the GST officer, the change will reflect on the GST portal.

Step 7: Confirmation

- After the changes are approved, you will receive a confirmation message on the registered mobile number and email.

- The updated registration certificate will be available for download from the ‘Services’ tab under ‘User Services’.

Important Points to Remember

- The changes may take up to 15 working days to be processed.

- During the waiting period, ensure to check your email and GST portal dashboard for any communication from the GST department.

- The name change will not affect your GSTIN since it is linked to your PAN.

Conclusion

To change proprietor Name in GST Portal is a straightforward process that requires careful attention to detail and proper documentation. By following the steps outlined above, you can ensure that your GST records are current and in compliance with the legal requirements. Always keep your documents ready, and if you encounter any challenges, do not hesitate to contact the GST helpdesk for assistance. Keeping your business information up-to-date on the GST portal is not only a regulatory requirement but also a good business practice that maintains the trust and credibility of your business.