- Basic

Enquire Us

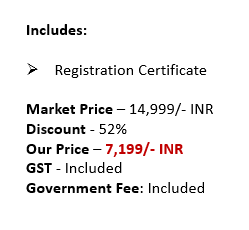

PF Registration

Employee Provident Fund (EPF) is a savings scheme for employees in India that is administered by the Employees’ Provident Fund Organization (EPFO). It is a mandatory social security scheme that was established under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

Under the EPF scheme, both the employee and the employer contribute a certain percentage of the employee’s salary to the EPF account. The contribution rate is currently set at 12% of the employee’s basic salary and dearness allowance, and the same amount is contributed by the employer. The contribution made by the employee is deducted from their salary, and the employer makes a matching contribution.

The EPF account earns interest, which is currently set at 8.5% per annum. The account holder can withdraw the accumulated balance in their EPF account at the time of retirement, or in case of certain emergencies such as illness, disability, or unemployment.

EPF provides social security benefits to employees by ensuring that they have a retirement savings fund. It also offers a measure of financial security to employees in case of emergencies.

Eligibility Criteria for EPF Registration?

Under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, all establishments that employ 20 or more employees are required to register for EPF. Once an establishment becomes eligible for EPF registration, all employees who are earning up to Rs. 15,000 per month are required to become members of the EPF scheme.

EPF registration is mandatory for the following types of establishments:

- Companies and organizations with 20 or more employees

- Factories engaged in any industry with 20 or more employees

- Coal mines and establishments with 20 or more employees

- Any other establishment specified by the government, with 20 or more employees

It is important to note that even if an establishment has less than 20 employees, they can voluntarily register for EPF. However, once an establishment is registered for EPF, they must continue to contribute to the scheme even if their employee count falls below 20.

If you are an employer or an employee and have any questions regarding EPF registration or eligibility.

The Breakup Of The PF Contribution

The contribution to the Employee Provident Fund (EPF) account is made by both the employee and the employer. The contribution rates are currently set at 12% of the employee’s basic salary and dearness allowance for both the employee and the employer. The breakup of the PF contribution is as follows:

- Employee Contribution: The employee’s contribution is deducted from their salary and is equal to 12% of their basic salary and dearness allowance. The employee’s contribution is directly deposited into their EPF account.

- Employer Contribution: The employer also contributes 12% of the employee’s basic salary and dearness allowance to the EPF account. Of the employer’s contribution, 8.33% is deposited into the Employee Pension Scheme (EPS) account and the remaining 3.67% is deposited into the EPF account.

- EPS Contribution: As mentioned above, the employer’s contribution of 8.33% is deposited into the EPS account. This contribution is calculated on the basis of the employee’s pensionable salary, which is capped at Rs. 15,000 per month. The EPS provides a pension to employees who have completed a minimum number of years of service.

- Insurance Contribution: In addition to the EPF and EPS contributions, employers are also required to make a contribution of 0.5% of the employee’s basic salary and dearness allowance to the Employee Deposit Linked Insurance Scheme (EDLI). The EDLI provides insurance coverage to employees in case of death while in service.

What is the Employees Pension Scheme?

The Employees’ Pension Scheme (EPS) is a pension scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It is administered by the Employees’ Provident Fund Organisation (EPFO) and is a part of the overall EPF scheme.

The EPS provides a pension to employees who have completed a minimum of 10 years of eligible service. Eligible service refers to the period during which an employee has been a member of the EPF scheme and has contributed to the EPS. The pension is payable for the lifetime of the pensioner and is transferable to the spouse in case of the pensioner’s death.

The EPS is funded by the employer’s contribution of 8.33% of the employee’s basic salary and dearness allowance, which is deposited into the EPS account. The government also contributes a portion of the pension fund.

The amount of pension payable to an employee is determined based on the employee’s pensionable salary and the length of their eligible service. The pensionable salary is the average of the employee’s basic salary and dearness allowance over the last 12 months of their service or the entire period of their service if it is less than 12 months. The pension is calculated at the rate of 0.5% of the pensionable salary for each year of eligible service.

Related Guides

ITR Services

Other Services

Documents Required

- PAN card of the employer and employees

- Address proof of the employer and employees

- ID proof of the employer and employees

- Bank account details of the employer

- Partnership deed or trust deed, in case of a partnership or trust

- Registration certificate, in case of a company

- Copy of the first sale invoice of the company, in case of a new establishment

- List of all employees with their basic salary and dearness allowance details

- Specimen signature of the authorized signatories

- Business registration proof such as GST certificate, MSME certificate, etc.