- Registration

- State License

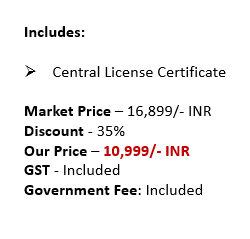

- Central License

Enquire Us

FSSAI Registration

FSSAI stands for Food Safety and Standards Authority of India. FSSAI registration is a mandatory requirement for all food businesses in India, including food manufacturers, food processors, food packagers, food importers, and food retailers. The objective of FSSAI registration is to ensure that food products sold or manufactured in India are safe and meet quality standards.

FSSAI registration is a process of obtaining a licence or registration from the Food Safety and Standards Authority of India (FSSAI). The FSSAI is the regulatory body responsible for ensuring the safety and quality of food products in India. FSSAI registration is necessary to ensure that food businesses comply with the safety and quality standards set by the FSSAI.

FSSAI registration is of three types based on the size and nature of the food business – Basic registration, State License, and Central License. Basic registration is required for food businesses with an annual turnover of up to Rs. 12 lakhs. State License is required for food businesses with an annual turnover of more than Rs. 12 lakhs and up to Rs. 20 crores. Central License is required for food businesses with an annual turnover of more than Rs. 20 crores.

FSSAI registration involves submitting an application form along with the necessary documents and paying the applicable fees. The FSSAI will then verify the application and documents and issue the licence or registration certificate if everything is found to be in compliance with the rules and regulations.

Eligibility criteria for FSSAI Registration

The eligibility criteria for FSSAI registration are as follows:

- Food Business Operator: The applicant must be a food business operator, including food manufacturers, food processors, food packagers, food importers, and food retailers.

- Annual Turnover: The annual turnover of the food business must be Rs. 12 Lac – Rs. 20 Crore additionally or per annum. for State License and more than Rs. 20 crores for Central License.

- Food Category: The food business must be involved in the manufacturing, processing, packaging, or distribution of food products.

- Infrastructure Requirements: The food business must have adequate infrastructure, such as a proper storage facility, hygienic workspace, and processing equipment.

- Food Safety Management System: The food business must have a proper food safety management system in place to ensure the safety and quality of the food products.

It is important to note that the eligibility criteria may vary depending on the type of FSSAI registration being obtained and the state in which the food business is located. Additionally, the food business may be required to provide additional documentation or undergo further verification procedures depending on the FSSAI’s requirements. It is advisable to check with the FSSAI or a qualified expert to ensure that all necessary criteria are in place before applying for FSSAI registration.

Difference Between Fssai Registration And Fssai License

Criteria | FSSAI Registration | FSSAI License |

Applicability | Small food businesses | Medium to large food businesses |

Eligibility | Turnover less than Rs. 12 lakhs | Turnover above Rs. 12 lakhs |

Validity | 1 to 5 years | 1 to 5 years |

Renewal | Required after expiration | Required after expiration |

Approval Time | 7 to 30 days | 45 to 60 days |

Documents Required | Basic documents | Additional documents |

Government Fees | Nominal fees | Higher fees |

Coverage | Covers basic food safety norms | Covers more advanced norms |

Compliance | Less compliance requirements | More compliance requirements |

Display of License | Not required | Mandatory |

FSSAI registration is applicable for small food businesses with a turnover of less than Rs. 12 lakhs, while FSSAI license is applicable for medium to large food businesses with a turnover above Rs. 12 lakhs. FSSAI registration is valid for 1 to 5 years, while FSSAI license is valid for 1 to 5 years as well.

Renewal is required after expiration for both registration and license. The approval time for FSSAI registration is generally 7 to 30 days, while it is 45 to 60 days for FSSAI license. The documents required for FSSAI registration are basic, while additional documents are required for FSSAI license. The government fees for FSSAI registration are nominal, while they are higher for FSSAI license. FSSAI license covers more advanced food safety norms and has more compliance requirements than FSSAI registration. Finally, displaying the license is mandatory for FSSAI license holders, while it is not required for those with FSSAI registration.

What are the documents required for FSSAI registration process

The documents required for FSSAI registration process may vary depending on the type of registration being obtained and the nature of the food business. However, in general, the following are some common documents required for FSSAI registration:

- Application Form: A duly filled and signed application form is required for FSSAI registration.

- Identity Proof: A valid identity proof such as a PAN card, Aadhaar card, passport, or driver’s licence is required.

- Address Proof: A valid address proof such as a passport, voter ID card, or electricity bill is required.

- Food Business Operator Declaration: A declaration form signed by the food business operator is required, stating that the food business complies with the food safety regulations and standards set by the FSSAI.

- Food Safety Management System Plan: A food safety management system plan detailing the food safety measures implemented by the food business is required.

- List of Food Products: A list of food products manufactured or sold by the food business is required.

- Photographs of Food Business Premises: Photographs of the food business premises, including the storage and processing areas, are required.

It is important to note that the specific documents required for FSSAI registration may vary depending on the type of registration being obtained and the state in which the food business is located.

Additionally, the food business may be required to provide additional documentation or undergo further verification procedures depending on the FSSAI’s requirements. It is advisable to check with the FSSAI or a qualified expert to ensure that all necessary documents are in place before applying for FSSAI registration.

How File With CA can help in FSSAI registration process

File With CA is an online platform that provides a wide range of business services, including FSSAI registration. Here’s how File With CA can help in the FSSAI registration process:

- Consultancy Services: File With CA offers consultancy services to help businesses understand the FSSAI registration requirements, and assist them in choosing the appropriate registration category.

- Documentation: File With CA can assist in preparing and submitting the necessary documents for FSSAI registration, ensuring that they are accurate and complete.

- Application Process: File With CA can help in submitting the FSSAI registration application and track its status, ensuring that the application is processed in a timely manner.

- Compliance Management: File With CA can provide ongoing support to ensure that the food business complies with the food safety regulations and standards set by the FSSAI.

- Renewals: File With CA can assist in the renewal of FSSAI registration, ensuring that the food business remains compliant with the FSSAI regulations and standards.

Overall, File With CA can provide comprehensive assistance with the FSSAI registration process, ensuring that the food business is compliant with the food safety regulations and standards set by the FSSAI, and enabling it to operate legally and efficiently.

Related Guides

Documents Required

- Latest electricity bill for the premises where GST registration is applied for.

- Latest telephone bill for the premises where GST registration is applied for in some states.

- Latest property tax receipt for the premises where GST registration is applied for.

- If the property is rented or leased, a lease or rental agreement is required.

- Passport-size photo of the authorized signatory under GST.

- If the applicant is a Partnership Firm, Partnership Deed must be submitted.

- If the applicant is a Company or LLP, Partnership Deed must be submitted.

- PAN card of the authorized signatory under GST.

- Aadhaar card of the authorized signatory under GST.

- If the property is taken by a person without a rental agreement.