- Basic

Enquire Us

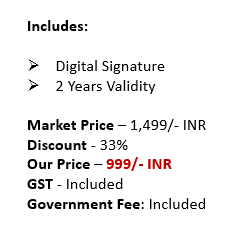

Digital Signature

A digital signature is a mathematical technique used to validate the authenticity and integrity of a digital document or message. It is essentially an electronic equivalent of a handwritten signature and provides a way to verify the identity of the signer and ensure that the document has not been altered or tampered with since it was signed.

A digital signature is created using a combination of public and private keys that are unique to the signer. The private key is kept secret by the signer and is used to create the digital signature, while the public key is shared with others and is used to verify the signature.

When a document is signed using a digital signature, the signature includes a hash, which is a mathematical algorithm that creates a unique value based on the contents of the document. This hash is then encrypted using the signer’s private key to create the digital signature. Anyone with the signer’s public key can then verify the signature by decrypting the hash and comparing it to a new hash created from the document’s contents.

Digital signatures are electronic signatures that are used to sign and authenticate electronic documents, such as Income Tax returns, GST returns, and MCA filings. Here is an explanation of digital signatures in the context of Income Tax, GST, and MCA:

Income Tax

Digital signatures are mandatory for signing Income Tax returns filed electronically by companies and individuals whose accounts are required to be audited under the Income Tax Act. Digital signatures can be obtained from any of the licensed Certifying Authorities (CA) in India. The digital signature ensures the authenticity of the return filed and prevents any unauthorized access or tampering of the document. It also eliminates the need for physical submission of the signed copy of the return.

GST

Digital signatures are required for GST registration, GST return filing, and GST refund applications. The digital signature ensures the authenticity of the documents submitted and also acts as a safeguard against fraudulent activities. The digital signature can be obtained from any of the licensed Certifying Authorities (CA) in India. The use of digital signatures in GST processes streamlines the entire process and reduces the need for physical submissions.

MCA

Digital signatures are mandatory for signing all electronic documents filed with the Ministry of Corporate Affairs (MCA), such as Annual Returns, Financial Statements, and other forms. The digital signature ensures the authenticity and integrity of the documents filed and eliminates the need for physical submission of the signed copy of the document. The digital signature can be obtained from any of the licensed Certifying Authorities (CA) in India.

Documents Required For Digital Signatures

The documents required for obtaining a digital signature certificate (DSC) vary depending on the type of applicant and the DSC being obtained. However, in general, the following are some common documents required for obtaining a DSC:

- Application Form: A duly filled and signed application form is required for obtaining a DSC.

- Identity Proof: A valid identity proof such as a PAN card, Aadhaar card, passport, or driver’s licence is required.

- Address Proof: A valid address proof such as a passport, voter ID card, or electricity bill is required.

- Passport-size Photograph: A recent passport-size photograph of the applicant is required.

- Authorization Letter: In the case of a partnership firm or a company, an authorization letter from the authorised signatory must be provided.

- Digital Signature Application Form: A digital signature application form is required for obtaining a DSC. This form is provided by the DSC issuer and must be duly filled and signed by the applicant.

It is important to note that the specific documents required for obtaining a DSC may vary depending on the issuer’s requirements and the type of DSC being obtained. Additionally, the applicant may be required to undergo a background check or provide additional documentation depending on the issuer’s policies. It is advisable to check with the issuer or a qualified expert to ensure that all necessary documents are in place before applying for a DSC.

What Kind Of Assistance Do You Expect From File With Ca For A Digital Signature

If you are seeking assistance from File With CA for obtaining a digital signature, here are some of the services you can expect:

- Guidance on the type of digital signature: File With CA can guide you in choosing the appropriate type of digital signature based on your needs and the nature of the transaction.

- Assistance with the application process: File With CA can assist you in filling out the digital signature application form and collecting the necessary documents, ensuring that all required fields are filled accurately.

- Verification of documents: File With CA can help ensure that the documents submitted for the digital signature application are verified and meet the issuer’s requirements.

- Renewal assistance: File With CA can provide assistance with renewing the digital signature certificate to ensure that it remains valid and compliant with legal requirements.

- Troubleshooting issues: File With CA can help troubleshoot any issues related to the digital signature, such as if the digital signature is not working properly or if there are any errors in the signing process.

- Compliance with legal requirements: File With CA can help ensure that the digital signature process is compliant with legal requirements and that all necessary documentation is in place.

Overall, File With CA can provide comprehensive assistance with the digital signature process, ensuring that it is secure, efficient, and compliant with legal requirements, while also providing ongoing support to help resolve any issues that may arise.

Related Guides

Documents Required

Nill