- Basic

Enquire Us

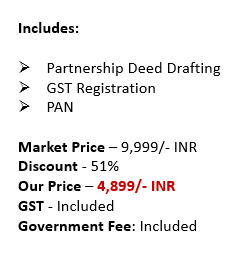

Partnership firm

A partnership is a popular form of business structure that involves two or more individuals who agree to share the ownership, management, and profits of a business. This guide provides an in-depth understanding of partnerships, including their definition, how they work, taxation, and the various types.

A partnership is a business arrangement in which two or more individuals (partners) come together to contribute their resources, skills, and expertise to establish, operate, and share the profits and losses of a business venture.

How a Partnership Works

Formation: A partnership is formed through a mutual agreement between the partners, either written or oral. However, a written partnership agreement is highly recommended to avoid potential disputes.

Management: Partners share the responsibility of managing the business, making decisions, and overseeing day-to-day operations.

Profit and Loss Sharing: The partners agree upon the distribution of profits and losses, as outlined in the partnership agreement.

Liability: In general partnerships, each partner has unlimited liability for the debts and obligations of the business.

Dissolution: A partnership may be dissolved upon the death, bankruptcy, or withdrawal of a partner, or by mutual consent of the partners.

Taxation of Partnerships

Pass-through taxation: Partnerships are not subject to corporate income tax. Instead, profits and losses are “passed through” to the partners, who report them on their individual income tax returns.

Self-employment taxes: Partners are considered self-employed and must pay self-employment taxes, which include Social Security and Medicare taxes.

Estimated tax payments: Partners are required to make estimated tax payments throughout the year to cover their tax liabilities.

Types of Partnerships

General Partnership (GP): A general partnership consists of partners who actively participate in the management of the business and have unlimited personal liability for the business’s debts and obligations.

Limited Partnership (LP): In a limited partnership, there are one or more general partners who manage the business and assume unlimited personal liability, and one or more limited partners who invest capital but do not participate in management and have limited liability.

Limited Liability Partnership (LLP): An LLP offers limited liability protection to all partners, who are not personally responsible for the debts and obligations of the business. This structure is popular among professional service providers, such as lawyers and accountants.

Advantages and Disadvantages of Partnerships

Advantages | Disadvantages |

1. Easy to establish | 1. Unlimited liability (for general partners) |

2. Shared management and decision-making | 2. Potential for conflicts and disagreements |

3. Pooling of resources and skills | 3. Difficulty in transferring ownership |

4. Increased borrowing capacity | 4. Lack of continuity |

5. Pass-through taxation (avoid double taxation) | 5. Imbalance in workload and responsibilities |

6. Flexibility in profit and loss sharing | 6. Legal exposure of personal assets |

7. Attracts investors (for LPs and LLPs) | 7. Self-employment taxes |

What About Limited Partnerships?

Limited partnerships (LPs) are a type of partnership where there are two types of partners: general partners and limited partners. In a limited partnership, the general partner(s) manage the business and have unlimited personal liability for the debts and obligations of the business, just like in a regular partnership. However, the limited partner(s) are only liable for the debts and obligations of the business up to the amount of their investment.

Limited partnerships can offer some advantages over regular partnerships, such as:

- Limited Liability: Limited partners are not personally liable for the debts and obligations of the business beyond the amount of their investment.

- Passive Investment: Limited partners can invest in the business and receive a share of the profits without being involved in the day-to-day management of the business.

- Tax Benefits: Like regular partnerships, limited partnerships are not taxed at the corporate level. Instead, profits and losses are passed through to the partners and reported on their individual tax returns.

However, limited partnerships also have some disadvantages, such as:

- General Partner Liability: The general partner(s) have unlimited personal liability for the debts and obligations of the business.

- Limited Partner Restrictions: Limited partners are restricted in their ability to participate in the management of the business. If a limited partner becomes too involved in the management of the business, they may lose their limited liability protection.

- Complexity: Limited partnerships can be more complex to set up and manage than regular partnerships.

It is important to carefully consider the advantages and disadvantages of a limited partnership before deciding to form one.

Conclusion

A partnership is an appealing business structure for those who wish to collaborate with others to share their resources, skills, and expertise. Understanding the workings, taxation, and types of partnerships is crucial for entrepreneurs considering this form of business. Additionally, having a well-drafted partnership agreement can help prevent disputes and ensure the smooth functioning of the partnership.

Related Guides

Documents Required

- Partnership Deed

- PAN Card

- Address Proof

- ID Proof

- Registration Certificate

- Bank Account

- Tax Registration

- Business License

- Insurance

- Annual Filings