TDS Return Filings

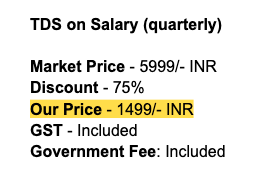

- Basic

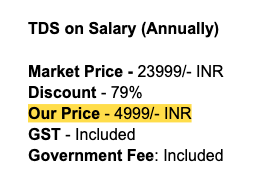

- Intermediate

Enquire Us

Mastering TDS Return Filing | A Step-by-Step Guide to Simplify Your Tax Deduction Process

Our TDS (Tax Deducted at Source) return filing services are designed to help businesses and professionals comply with TDS regulations seamlessly and accurately. We provide end-to-end assistance in the entire TDS return filing process, ensuring timely submissions and minimizing the risk of errors and penalties.

TDS (Tax Deducted at Source) is a mechanism used by the government to collect income tax at the source of income generation. It is applicable to various income sources, such as salary, interest, commission, rent, and professional fees. As per the Income Tax Act, any person or organization responsible for making payments to an individual or entity is required to deduct tax at the source if the payment exceeds a specified threshold limit. TDS Return Filing is the process of submitting details of the tax deducted at source to the Income Tax Department.

Here is detailed information about TDS Return Filing:

- TDS Return Forms: There are different forms for filing TDS returns based on the type of payment made. Some common forms include:

- Form 24Q: For TDS deducted from salary payments

- Form 26Q: For TDS deducted from all other payments (excluding salary)

- Form 27Q: For TDS deducted from interest, dividends, or any other sum paid to non-residents

- Form 27EQ: For TDS collected at source (TCS)

- TDS Return Filing Due Dates:

- For Form 24Q (Salary)

- Q1 (April to June): 31st July

- Q2 (July to September): 31st October

- Q3 (October to December): 31st January

- Q4 (January to March): 31st May

- For Forms 26Q, 27Q, and 27EQ (Non-Salary):

- Q1 (April to June): 31st July

- Q2 (July to September): 31st October

- Q3 (October to December): 31st January

- Q4 (January to March): 15th May

- For Form 24Q (Salary)

- TDS Return Filing Procedure:

Collect the necessary information, such as the deductor’s and deductees’ PAN, TAN, amount of tax deducted, and the TDS challan details.

Choose the appropriate TDS return form based on the type of payment.

Fill in the required details in the form, either manually or using TDS return preparation software.

Validate the return using the File Validation Utility (FVU) provided by NSDL or any other certified agency.

Submit the return electronically through the e-filing portal of the Income Tax Department or physically at TIN-FC (Tax Information Network Facilitation Center).

- Penalties for Late or Non-Filing of TDS Returns:

Late filing fee: A fee of INR 200 per day is levied for late filing, but the total fee cannot exceed the total amount of TDS.

Penalty: A penalty ranging from INR 10,000 to INR 1,00,000 can be imposed for non-filing or incorrect filing of TDS returns.

Interest: If the TDS is not deducted or not deposited on time, interest is charged at 1% per month for non-deduction and 1.5% per month for non-payment.

TDS Certificate: After filing the TDS return, the deductor must issue a TDS certificate (Form 16 for salary and Form 16A for non-salary) to the deductee. This certificate provides details of the tax deducted and deposited on behalf of the deductee.

TDS Refund: If the tax deducted at source is more than the actual tax liability, the deductee can claim a refund by filing an income tax return. The Income Tax Department processes the refund after verifying the claim.

TDS Certificate

A TDS (Tax Deducted at Source) Certificate is a document issued by the deductor (the person or organization responsible for deducting tax at source) to the deductee (the person whose income is subject to tax deduction). The certificate provides details of the tax deducted and deposited on behalf of the deductee. It serves as proof that the appropriate TDS has been deducted and deposited with the government.

There are two types of TDS Certificates:

- Form 16: This certificate is issued to salaried employees by their employers. Form 16 provides a detailed summary of the salary earned, tax deductions, exemptions, and the total TDS deducted and deposited on behalf of the employee. The employer is required to issue Form 16 to the employee by May 31st following the end of the financial year (April to March).

Form 16 has two parts:

- Part A: Contains details of the employer, employee, PAN (Permanent Account Number), and TAN (Tax Deduction and Collection Account Number) of the employer, and the amount of TDS deducted and deposited for each quarter of the financial year.

- Part B: Provides a detailed breakdown of salary components, exemptions, deductions, and the net taxable income of the employee.

- Form 16A: This certificate is issued for non-salary income, such as interest income, rent, commission, or professional fees. Form 16A is issued by the deductor to the deductee on a quarterly basis, within 15 days from the due date of filing the TDS return for that quarter.

Form 16A contains the following information:

- Name and address of the deductor and deductee

- PAN of both the deductor and deductee

- TAN of the deductor

- Nature of income for which tax has been deducted

- Amount paid to the deductee and the TDS deducted and deposited

- Date of tax deduction and deposit

TDS Certificates are essential for the deductee to claim credit for the tax deducted at source while filing their income tax return. They can also be used as evidence in case of any discrepancies or issues with the tax authorities.

What If You Choose a File With CA

Comprehensive Support:

Our experienced team of tax professionals provides complete support in filing TDS returns for various types of deductions, ensuring compliance with the Income Tax Act and relevant rules.

Accurate Calculations:

We use advanced software tools to ensure accurate calculations of TDS liabilities, minimizing the risk of errors and penalties.

E-filing:

We offer a user-friendly e-filing platform, making it easy for you to submit your TDS returns electronically, saving time and reducing paperwork.

Timely Filing:

We help you adhere to the prescribed deadlines for filing your TDS returns, ensuring timely submission and avoiding late filing penalties.

Data Security & Confidentiality:

We take utmost care to protect your sensitive financial information with robust security measures and maintain complete confidentiality.

Post-filing Assistance:

Our support extends beyond filing your TDS returns. We provide assistance in case of any TDS-related notices, queries, or rectifications that may arise after the filing process.

Steps to File Your TDS Return

- Register or log in to our secure e-filing platform.

- Provide your business and deduction-related information.

- Upload relevant documents, such as Form 16A, Form 26Q, Form 27Q, and other supporting documents.

- Our experts will review your information and calculate your TDS liabilities.

- Review your TDS return summary and approve it for filing.

- Pay any outstanding TDS dues, if applicable.

- Submit your TDS return electronically.

- Receive acknowledgment and confirmation of your TDS return filing.

Our TDS return filing services simplify the process for businesses and professionals, ensuring compliance with TDS regulations and minimizing the risk of errors and penalties.

Related Guides

Documents Required

For filing TDS (Tax Deducted at Source) returns in India, various documents and details are required. Here’s a list of key documents required for TDS Return Filing Services:

- PAN (Permanent Account Number) Cards

- TAN (Tax Deduction and Collection Account Number)

- Form 26AS

- Challan Receipt Number

- Deductee’s Details: Details of the Tax Deducted

- Salary details

- Bank Challan

- Bank Statement: Details of Returns Filed Previously

Frequently Asked Questions (FAQs)

TDS is a method of tax collection where the payer of income deducts tax at source before making a payment to the payee. The deducted amount is then deposited with the government on behalf of the payee.

Any individual or entity responsible for deducting TDS and depositing it with the government is required to file a TDS return, providing details of the deductions and the corresponding payments made.

The most common types of TDS returns include Form 24Q (for salary payments), Form 26Q (for non-salary payments to residents), and Form 27Q (for non-salary payments to non-residents).

TDS returns are filed quarterly, and the deadlines for filing are as follows:

- Quarter 1 (April - June): July 31

- Quarter 2 (July - September): October 31

- Quarter 3 (October - December): January 31

- Quarter 4 (January - March): May 31

Yes, you can file a revised TDS return if you discover any mistakes or omissions in your original return. There is no specific deadline for filing a revised return, but it is advisable to do so as soon as possible to avoid complications or penalties.