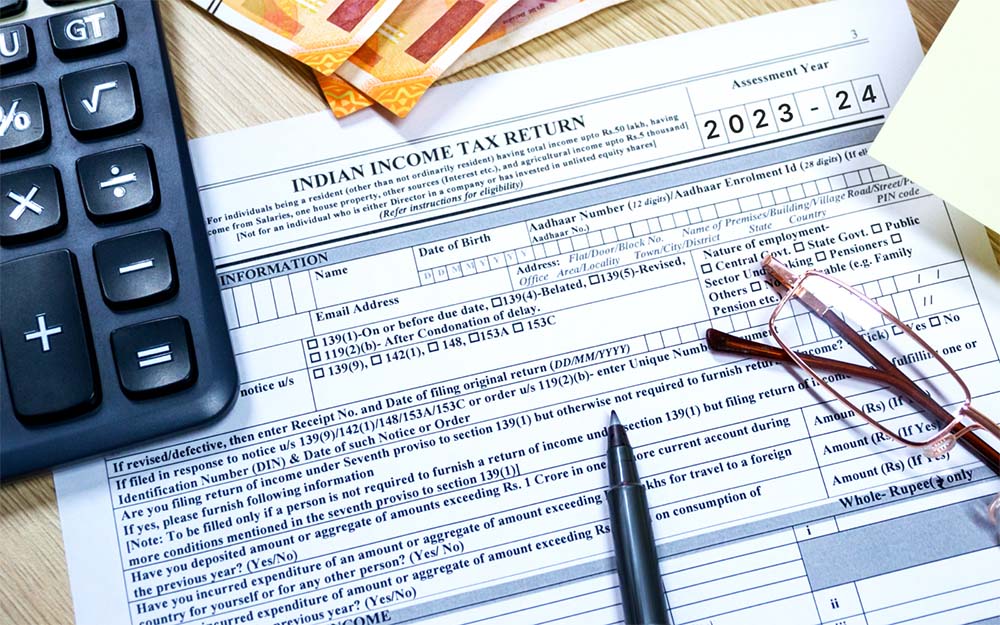

Which ITR Form Is for Salaried Person in India | Feb 2024

Filing Income Tax Returns (ITR) is an annual ritual that salaried individuals in India must partake in to comply with tax regulations. However, one of the most common areas of confusion is selecting the appropriate ITR form. The Income Tax Department of India has specified different ITR forms for various types of income and taxpayers. For salaried individuals, understanding which ITR form to use is crucial for a correct and hassle-free tax filing process.

Understanding ITR Forms

The Income Tax Department categorizes taxpayers into different groups based on the nature and amount of income, and provides specific ITR forms for each category. The forms most relevant to salaried individuals are ITR-1 and ITR-2.

- ITR-1 (SAHAJ):

- Applicability: This form is meant for resident individuals having a total income up to Rs. 50 lakh, comprising income from salaries, one house property (excluding cases where loss is brought forward from previous years), other sources (like interest), and agricultural income up to Rs. 5,000.

- Inapplicability: It’s not for individuals who are either directors in a company, have invested in unlisted equity shares, or have income from capital gains, lottery, racehorses, legal gambling, etc.

- Ease of Use: ITR-1 is designed to be straightforward and user-friendly, making it suitable for most salaried individuals.

- ITR-2:

- Applicability: This form is for individuals and HUFs not having income from profits and gains of business or profession. It is suitable for salaried individuals with more complex income structures, such as capital gains, more than one house property, income from other sources, or income from outside India.

- Inapplicability: It cannot be used by individuals who have income from business or profession.

Choosing the Right Form

- Assessing Income Sources: If your income solely consists of salary and interest, and does not exceed Rs. 50 lakh, ITR-1 is the appropriate form. However, if you have multiple sources of income like capital gains, income from more than one house property, or foreign income, ITR-2 becomes necessary.

- Understanding Tax Rules: Keep abreast of the latest tax rules and regulations as they can affect the applicability of ITR forms. For instance, changes in rules regarding dividend income or capital gains can influence which form you should use.

- Consulting a Tax Expert: If you find it challenging to decide, consulting a tax expert or a chartered accountant is advisable, especially in cases of complex income structures.

Online Filing

The Government of India encourages the e-filing of ITRs. The online process is streamlined and user-friendly. You can file your ITR on the official Income Tax e-filing website. It’s essential to have all necessary documents like Form 16, bank statements, and details of investments handy.

Conclusion

For salaried individuals, choosing the right ITR form is fundamental for a correct and efficient tax filing process. ITR-1 (SAHAJ) is suitable for most salaried taxpayers with a straightforward income structure, while ITR-2 caters to those with more diverse income sources. Staying informed about the latest tax regulations and seeking professional advice when needed can greatly ease the process of tax filing. Remember, timely and accurate filing of tax returns is not just a legal obligation but also a step towards responsible citizenship.

Leave a Reply